Forbes Indonesia 2013 April (e-magazine full)

Bạn đang xem bản rút gọn của tài liệu. Xem và tải ngay bản đầy đủ của tài liệu tại đây (14.08 MB, 84 trang )

Indonesia

APRIL 2013

VOLUME 4 ISSUE 4

WW W.FORBESINDONESIA.COM

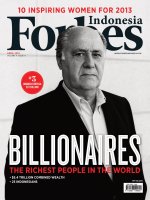

10 INSPIRING WOMEN FOR 2013

#

3

AMANCIO ORTEGA

$57 BILLION

THE RICHEST PEOPLE IN THE WORLD

• $5.4 TRILLION COMBINED WEALTH

• 25 INDONESIANS

RP 50,000

#

3

AmAncio ortegA

$57 Billion

10

www.bankmayapada.com

Mayapada Tower, Ground Floor – 3rd Floor

Jend. Sudirman Kav.28 Jakarta 12920 – Indonesia

Phone : +62 21 5212288, +62 21 5212300

Leading you to Indonesia

For over two decades, Bank Mayapada has proven to be a strong and reputable bank

in Indonesia. We offer a wide range of financial services to meet our clients’ personalized

business needs supported by state of the art IT and knowledgeable staff. With over than

170 branches in 19 provinces in Indonesia, Bank Mayapada will continue to serve the ever

growing economy in Asia.

dps mayapada final.indd 8 7/3/12 7:46 PM

www.bankmayapada.com

Mayapada Tower, Ground Floor – 3rd Floor

Jend. Sudirman Kav.28 Jakarta 12920 – Indonesia

Phone : +62 21 5212288, +62 21 5212300

Leading you to Indonesia

For over two decades, Bank Mayapada has proven to be a strong and reputable bank

in Indonesia. We offer a wide range of financial services to meet our clients’ personalized

business needs supported by state of the art IT and knowledgeable staff. With over than

170 branches in 19 provinces in Indonesia, Bank Mayapada will continue to serve the ever

growing economy in Asia.

dps mayapada final.indd 8 7/3/12 7:46 PM

2 | FORBES INDONESIA APRIL 2013

Indonesia

8 FACT & COMMENT Steve Forbes

They succeed by meeting your needs.

10 THOUGHT LEADERS Paul Johnson

The war on drugs a defining moment.

11 DELIVERING INFRASTRUCTURE Raj Kannan

Taking the bull by the horns.

ISSUES & IDEAS

12 SOCCER DIPLOMACY

Australia’s Intrepid Mines is using soccer diplomacy and other tactics

to regain a stake in the Tujuh Bukit gold mine, worth billions.

BY JEFFREY HUTTON

16 VOX POPULI ONLINE

PoliticaWave’s Sony Subrata and Yose Rizal have tapped social media

to make more accurate political predictions.

BY SONYA ANGRAINI

18 FRESH THOUGHT Tauk Darusman

Hard truth.

19 REALITY CHECK James Kallman

Paying for privacy.

20 GLOBAL VIEWPOINT Jennie S. Bev

2020 megatrends and Indonesia.

21 GUEST COLUMN Eric Lascelles

Looking for trouble in Indonesia.

INSPIRING WOMEN

23 10 INSPIRING WOMEN

These 10 women have succeeded in various endeavors, and represent a diversity

of backgrounds. They show how women can and do have a major impact

in whatever is their chosen profession or passion.

40 10 HONOR ROLL

For good measure, we have included another 10 on our honor roll.

COVER PHOTOGRAPH BY

DUSKO DESPOTOVIC / SYGMA / CORBIS

contents — april 2013 volume 4 issue 4

p PAGE 24

“When I started

the sIntesa group

In 1999, I told my

father that I Was

no longer hIs staff

but hIs partner.”

— shInta KamdanI,

ChIef exeCutIve sIntesa group

APRIL 2013 FORBES INDONESIA | 3

BNI APRIL 2013 EDIT 1 3/6/13 3:15 PM

4 | FORBES INDONESIA APRIL 2013

BILLIONAIRES

48 THE TOP 20

This elite group is worth $714 billion, $80 billion more than last year.

52 INDONESIA’S RICHEST

With 25 billionaires, Indonesia now ranks ahead of Japan in billionaires.

54 FROM OLIGARCH TO PRESIDENT?

Mikhail Prokhorov is a tycoon in Russia, Jay-Z’s partner in Brooklyn—and a strong

candidate to eventually replace Vladimir Putin in the Kremlin, a prospect the

billionaire is turning into his full-time job.

BY KATYA SOLDAK

60 DOGS BARK, BUT THE CARAVAN ROLLS

Pham Nhat Vuong’s valuation defies a fiercely dicult property sector in Vietnam.

BY LAN ANH NGUYEN

ENTREPRENEUR

64 FLORAL BEAUTY

Harijanto Setiawan has successfully transformed flowers

into art with extraordinary value.

BY YESSAR ROSENDAR

67 CEO WISDOM Andrew Tani

Dragon boat leader.

68 TILE TIME

With Arwana Citramulia, Tandean Rustandy created the country’s

second largest tile maker by serving smaller cities and rural areas.

BY SONYA ANGRAINI

70 INTRICATE CREATIONS

Nancy Goh has developed her Bagteria handbags into a global brand.

BY YESSAR ROSENDAR

72 MARKETING INSIGHTS Hermawan Kartajaya

Singkawang: WOW!

73 LEGAL VIEW Eddy Leks

Balancing franchise growth with aid to SMEs.

FORBES LIFE

74 WARRIORS, HORSES & BLOOD

On Sumba, the ancient pasola battle still thrives to help secure a good harvest.

BY MUHAMMAD FADLI

78 THE EYE Yessar Rosendar

PAGE 68 u

“my dream Is that In the

future, When people

talK about CeramIC

tIles, arWana Is the fIrst

name they thInK of.”

—tandean rustandy,

ChIef exeCutIve pt arWana CItramulIa

p

PAGE 70

“eaCh bagterIa

bag has a soul

and story behInd

I

t. I belIeve that’s

Why people

appreCIate It.”

— nanCy goh,

founder bagterIa bag

contents — april 2013 volume 4 issue 4

APRIL 2013 FORBES INDONESIA | 5

CIMB NIAGA APRIL 2013 EDIT.pdf 1 3/22/13 6:54 PM

6 | FORBES INDONESIA APRIL 2013

FORBES INDONESIA

siDelines

O

ne of the missions of Forbes Indonesia is to provide role models and,

by extension, inspiration, whether one is an aspiring entrepreneur or

an established billionaire. This issue has not one but two sets of role

models to provide inspiration. The first is our cover subject of billionaires, the

wealthiest role models on the planet. They show what can be done—on a grand

scale. Their stories are varied—these men and women come from a wide variety

of backgrounds and experience, demonstrating that the path to great wealth is

not a narrow one but one with many avenues of opportunity.

For a near-perfect example, we have in this issue a profile of the first bil-

lionaire in Vietnam, Pham Nhat Vuong of the Vingroup. Turning closer to home,

what is happening here in Indonesia in the billionaire arena is also inspiring.

The country can now boast it has 25 billionaires. In the Asia-Pacific region, this

figure puts Indonesia as the home to the fifth-largest group of billionaires, ahead

of much wealthier countries such as Australia, Japan and Singapore.

The second group in this issue to bring inspiration is our inaugural set of

10 inspiring women, accompanied by an honor roll of another set of 10 women.

Unlike the billionaires list, these women are not all entrepreneurs. Instead the

idea was to present a cross section of disciplines, such as politicians, celebrities

and athletes. By doing this, it shows that inspiration for women can come in

many areas of endeavor and that women are achieving success in a variety of

fields. Entrepreneur Shinta Dhanuwardoyo pioneered the Internet advertising

agency Bubu, a sector that normally is dominated by men. At one trade show

in the early days of her company, a potential customer kept asking to speak to

her boss, refusing to believe that a women could hold that position. Our private

equity investor Veronica Lukito of Ancora notes that companies that include a

mix of men and women perform better than those without women. Veronica too

has succeeded in another male-dominated industry.

One of the points of presenting this group of 20 women is not to do a long

list—it is meant to be more of a sample showing the diversity of accomplish-

ment. One area of disappointment is that unfortunately these two lists don’t

have any area of overlap. The 25 Indonesian billionaires don’t include a single

woman. Indonesia has come a long way, and women are rising in the ranks of

accomplished businesspeople, both in stature and net worth. Under “lifetime

achievement” we include Martha Tilaar, as she is truly a pioneer of women en-

trepreneurs for the country, starting with one small beauty salon in 1970. Yet

this lack on the billionaires list could also be a source of inspiration, for perhaps

there is a woman out there who will strive to claim the title to be the first to

enter the billionaires club. Having a woman billionaire would no doubt inspire

others to follow in her footsteps.

f

INSPIRING

ROLE MODELS

Indonesia

Justin Doebele

Chief Editorial Advisor

EDITORIAL DEPARTMENT

Chief E

dit

orial A

dvisor

Justin Doebele

Edit

or-

At

-Large Tauk Darusman

M

anaging E

dit

or Ferry Irwanto

Senior Writers Ardian W

ibisono

W

riters Ulisari Eslita, Gloria Haraito,

Renjani P

us

po Sari

Report

ers Sonya Angraini, Y

essar R

osendar

A

rt Director Mirna Lidya Aprilla

Photo E

dit

or Ahmad Zamroni

E

xecutive Assistant Seli W

idia

ti

BUSINESS DEP

AR

TMENT

Publisher Jusuf W

anandi

A

ssociate Publisher Grace W

on

g

Circulation & Subscription Manager Andriansyah

Circulation Executive Fitriyah

Production Manager Mudad Riyanto

Senior A

dv

. Manager Tanti Jumiati

Senior A

dv

. Sales Executive Hilman Ahmad

PR & E

v

ent Manager Rai Ismael

E

xecutive Assistant Marketing Nancy H

er

yana

Ac

counting Manager Indrawati Sonjaya,

Benny Tjoa

Ac

counting Supervisor Inge Stephanie

Ac

counting Executives Tjhin Anna

Adminis

trative Assistant Dahlia K

omala S

ari

P

T

WAHANA MEDIATAMA

President Director Millie Stephanie

Vice President Director Victoria Tahir

President Commissioner Jonathan Tahir

Vice President Commissioner Maria L

u

kito

FOR

BES MEDIA LLC

Chairman & E

dit

or-in-Chief Steve Forbes

President & CEO Mike P

e

rlis

Chief Product Ocer L

e

wis D’Vorkin

CEO / Asia W

illi

am Adamopoulos

Edit

or, F

orbes

Asia Tim Ferguson

FORBES INDONESIA is published by PT Wahana Mediatama under

a license agreement with Forbes LLC, 60 Fifth Avenue, New York,

New York 10011. “FORBES” is a trademark used under license from

FORBES LLC.

©2010 PT Wahana Mediatama • ©2010 FORBES LLC, as to material

published in the U.S. Edition of FORBES. All Rights Reserved.

©2009 FORBES LLC, as to material published in the edition of

FORBES ASIA. All Rights Reserved.

FORBES INDONESIA is published monthly, 12 times per year.

Copying for other than personal use or internal reference or of

articles or columns not owned by FORBES INDONESIA without

written permission of FORBES INDONESIA is expressly prohibited.

CONTACT INFORMATION

Forbes Indonesia: Menara Sudirman 19th Floor Suite 19D,

Jl. Jendral Sudirman Kav. 60, Jakarta 12190. Tel: (021) 522 6828,

Fax: (021) 522 7208. Website: www.forbesindonesia.com

: Forbes Indonesia Magazine : @forbes_id

Subscriber Enquiries: Please contact Circulation Division. SMS to

0817 0109 777, email: Or visit

www.forbesindonesia.com to subscribe or advertise. Single copy

price Rp 50,000, local subscription rate

Rp 420,000 + postal fee (Jabodetabek) for 12 issues.

april 2013 • Volume 4 issue 4

APRIL 2013 FORBES INDONESIA | 7

MAZDA APRIL 2013 EDIT.indd 1 3/25/13 10:16 AM

8 | FORBES INDONESIA APRIL 2013

Fact & comment — steve ForBes

FORBES INDONESIA

“With all thy getting, get understanding”

The impressive increase in the

net worth of the world’s billionaires

and the fact that there are 200 more of

these folks than there were a year ago

will have leftists everywhere decrying

the growing gap between the haves and

the have-nots. After all, they’ll howl,

why should the ranks and wealth of the

wealthy grow while most of the world’s

economies are struggling? But don’t

blame these rich for the governments’

poor economic policies. More to the

point, the overwhelming majority of

these people have moved ahead through meeting

the needs and wants of other people, not through

inheritances or crony capitalism. Their successes

didn’t come at the expense of everyone else. Free-

market capitalism is not a zero-sum system.

In fact, we should take heart from this list. It

demonstrates that, despite pervasive

antigr

owth

policies almost everywhere, the entrepreneurial

spirit is showing surprising resiliency worldwide.

Amancio Ortega from Spain has displaced

Warren Buett in the No. 3 spot by providing

low-priced fashions. GoPro’s Nicholas Woodman

demonstrates that you can take your passion and

become rich pursuing it: Who’d have thought that

a guy interested in dangerous, high-skill sporting

activities would come to be worth $1 billion

and not just another bum? Tory Burch was an

unknown just a few years ago. As was Diesel jeans

mogul Renzo Rosso.

We’ve already seen astonishing rises in the glob-

al standard of living since the fall of the Berlin Wall

and the abandonment of communism in China.

Someday the current bout of government economic

malpractice will pass, and it will be the conven-

tional wisdom of governments to pursue low-tax

and sound-money policies. The impressive upward

march of humanity will again resume vigorously.

THEY SUCCEED

BY MEETING YOUR NEEDS

The Daily Show’s Jon Stewart should be

awarded a Nobel Prize in economics.

The Nobel committee wouldn’t even

have to issue a new one; it could just

revoke the one it awarded to New

York Times columnist Paul Krugman

in 2008. In January Stewart spoofed

the idea of the trillion-dollar platinum

coin, which had been floated as a way

of getting around the ceiling on the

national debt. The debt-ceiling crisis will reemerge

soon, as will this silly proposal—the notion that

the Treasury can mint such a coin and then turn

it in to the Federal Reserve for cash to keep the

government going.

Money out of thin air! Why wasn’t this

thought of before? As Stewart asked, why not a

$20 trillion coin? You can watch his hilarious take

at />january-10-2013/the-trillion-dollar-coin.

You’d think the coin nostrum was invented as

a joke by Saturday Night Live or The Daily Show,

but people like Krugman take it oh-so-seriously.

After all, as Krugman said, “Money is a social

contrivance,” something to be played with for our

own good by our betters in Washington. Krugman

is so self-serious that he lashed out at Jon Stewart,

calling him lazy and accusing him and his sta of a

“lack of professionalism.”

Stewart understood the issue all right: It is

idiotic and destructive. Stewart noted that “we

need to take the U.S. dollar seriously again.” Amen

to that!

Perhaps we should draft Jon Stewart to replace

Federal Reserve Chairman Ben Bernanke, whose

monetary policies are doing immense harm to the

U.S. and global economies.

f

A Nobel Man

BY STEVE FORBES, EDITOR-IN-CHIEF

APRIL 2013 FORBES INDONESIA | 9

UBS APRIL 2013 EDIT.indd 1 3/26/13 8:58 PM

10 | FORBES INDONESIA APRIL 2013

thought leaDers

paul Johnson — current events

The BriTish government’s bill to

make gay marriage legal has already

had serious consequences. It has split

the Conservative Party wide open

and threatens to make its defeat in

the next election, already quite likely,

absolutely certain. It may also have di-

sastrous eects on the churches. An-

glicans, belonging to a church that is

established by law as a national body,

are afraid that if the bill becomes law

any of their clergy who refuse to per-

form a same-sex marriage ceremony

will face criminal prosecution. Law-

yers foresee years of intense argu-

ment, appeals and counter-

appeals

,

accompanied by fat fees, stretching

into the indefinable future.

Once something is legal there’s

nothing to prevent a lobby being

formed by those who participate

in that activity, especially if there’s

money to be made. An important

example of this is the movement to

legalize recreational drugs.

The war on drugs is dicult and

expensive, and there are signs that

it is faltering, with battle lines being

drawn. Many people, particularly in

the entertainment industry, are al-

ready campaigning to legalize a vari-

ety of so-called soft (or recreational)

drugs, such as marijuana. Indeed,

pro-drug lobbies already exist here in

the U.K. and in the U.S.

If society gives way on this, the

consequences will be momentous,

precisely because the profits to be

made from the marketing and selling

of soft drugs will be enormous. There

will be nothing to prevent a large-

scale international corporation being

formed solely to manufacture and

circulate such drugs. Equally, exist-

ing pharmaceutical companies will be

able to enter the trade. The competi-

tion will be fierce, which alone will

drive down prices. The products will

be “improved” and become more al-

luring. In no time supermarkets and

corner shops will be selling marijua-

na, and the term “drugstore” will ac-

quire a new and deadlier meaning.

Vast sums will be spent on pro-

motion, especially among the young.

Equally large amounts of money will

become available to expand the scope

of decriminalization, redefining the

border between soft and hard drugs to

eventually include heroin.

And what of the violent criminal

elements already involved in the

drug trade—the Taliban, which sells

and ships the fruit of the poppy out

of Afghanistan, and the cartels in

South and Central America that run

drugs into Mexico and the U.S.? The

violence surrounding the drug trade

will only escalate.

Another possibility to consider is

that a rogue state, such as North Korea,

will enter the burgeoning drug market.

North Korea’s evil regime survives by

performing tasks no other government

is able or willing to contemplate. For

instance, it has supplied nuclear tech-

nology to other rogue states in contra-

vention of all international law. Both

Syria and Iran have paid North Korea

in gold for its aid in their nuclear ef-

forts. There is no way to stop these

transactions as long as China refuses to

take punitive steps against its former

military and ideological ally.

TIPPING THE BALANCE

Recreational drugs are comparatively

easy for a ruthless and determined

government to grow and/or

manufacture. Supplying these drugs

to Americans is precisely the kind

of prospect that would appeal to the

North Korean leadership. They’ve

always claimed that capitalist

democracies are essentially corrupt

and decadent. This would enable

them to “prove” it,

especially if the

r

elease of vast quantities of cheap

soft drugs into Western cities were

followed by an increase in the supply

and use of hard drugs, as many

experts believe would be inevitable.

China, which has a drug problem

of its own, might be prepared to act

against North Korea in this context.

But it would extract a high price from

the West, which might result in the

balance of power in the Pacific tilting

in China’s favor.

I’ve been discussing possibilities.

But in the world of highly dangerous

drugs, it’s safer to treat possible

outcomes as probabilities. If we allow

this drug use to become legal, we’ll be

embarking on a voyage into horror

with our eyes open.

f

THE WAR ON DRUGS

A DEFINING MOMENT

PAUL JOHNSON, EMINENT BRITISH HISTORIAN AND AUTHOR; DAVID MALPASS, GLOBAL ECONOMIST, PRESIDENT OF ENCIMA GLOBAL LLC; AMITY SHLAES, DIRECTOR, THE 4% GROWTH

PROJECT, GEORGE W. BUSH INSTITUTE; AND LEE KUAN YEW, FORMER PRIME MINISTER OF SING APORE, ROTATE IN WRITING THIS COLUMN. TO SEE PAST CURRENT EVENTS COLUMNS, VISIT

OUR WEBSITE AT WWW.FORBES.COM/CURRENTEVENTS.

APRIL 2013 FORBES INDONESIA | 11

Delivering inFrastructure

raJ kannan

RAJ KANNAN IS THE FOUNDER AND MANAGING DIRECTOR OF TUSK ADVISORY WWW.TUSKADVISORY.COM. HE HAS OVER 20 YEARS OF EXPERIENCE IN TRANSACTING MAJOR INFRASTRUC

TURE PROJECTS AS WELL AS ADVISING AND ASSISTING CORPORATIONS AND GOVERNMENTS IN INFRASTRUCTURE PROJECTS. HE CAN BE CONTACTED AT RAJ.KANNANTUSK.SG

TAKING THE BULL

BY THE HORNS

I

n Indonesia’s realm of in-

frastructure, the role of the

Ministry of Finance (MoF) in

infrastructure delivery has re-

mained somewhat ad hoc. For

years, the market has been hoping for

a more direct involvement from MoF

in infrastructure delivery, in particu-

lar to increase the level of certainty of

the government’s contractual obliga-

tions under a concession agreement.

To its credit, the MoF in recent

years had taken some concrete steps to

improve the certainty of investment in

infrastructure projects by creating in-

stitutions and products that included

the establishment of Indonesia Infra-

structure Guarantee Fund (IIGF), an

agency to guarantee the government’s

contractual obligations under a con-

cession agreement for public private

partnership (PPPs) projects and the

launch of viability gap funding (VGF)

to improve projects’ bankability.

While IIGF is doing a great job

in its role as the extended arm of the

MoF, the implementation of VGF has

somewhat floundered since most proj-

ects seeking VGF have been poorly

prepared and lacked a risk framework

acceptable to the MoF. For these rea-

sons, the MoF is finally taking the pro-

verbial bull by the horns and decided

to establish a public private partner-

ship unit directly under its wings.

This new institutional framework

enables the MoF to assess and vet the

government’s fiscal support much

earlier in the project cycle, via its Risk

Management Unit (RMU). This step

negates the possibility of government

agencies going through the tender pro-

cess that eectively wastes the private

sector’s time—now projects that would

never qualify for government fiscal

support will not reach tender stage.

Part of this new infrastructure de-

livery paradigm is also the increased

recognition that the government must

pay for strategic infrastructure proj-

ects that are not yet fully financially

viable. In my previous column, I al-

luded to a newly proposed procure-

ment concept called a Performance

Based Annuity Scheme (PBAS) that

could likely become a de facto pro-

curement method for government

funding of infrastructure. I am happy

to say PBAS is getting a good hearing.

PBAS, in simple terms, is a PPP

scheme where a government con-

tracting agency (GCA), say a toll road

regulator, seeks proposals from a

private consortium to design, build,

finance and operate a toll road that is

not financially viable but is needed for

its economic importance. However,

to avoid the past problem of the gov-

ernment receiving substandard proj-

ects, a PBAS concession agreement

will stipulate that no payments will be

made until and unless the private sec-

tor delivers the project as agreed.

Once achieved, the GCA will make

annuity payments for the agreed pe-

riod, say 10 years. During the conces-

sion period the project consortium

will also be paid separate fees for op-

erations and maintenance of the toll

road, also subject to performance. No

doubt, a PBAS scheme is a contingent

liability on the government, which is

why its usage must be controlled with

the right risk level—something

that should involve institutions

such as the RMU and IIGF.

From the private sector, the

key success factor for schemes

like PBAS is their ability to

convince investors that they

can complete their projects. Ac-

cordingly, the completion guar-

antees from the consortium’s

contractors become important and the

banks may require the contractors to

joint venture with more capable part-

ners. PBAS may also spur the introduc-

tion of new financing schemes such as

project bonds tied to annuity payments.

In summary, the establishment of

the new PPP unit directly under the

MoF and government schemes like

PBAS are positive news for fixing the

infrastructure gap. I am hopeful that

the new Minister of Finance will

continue to spearhead these reforms.

f

the mof Is fInally taKIng

the proverbIal bull by

the horns and deCIded

to establIsh a publIC

prIvate partnershIp unIt

dIreCtly under Its WIngs.

12 | FORBES INDONESIA APRIL 2013

FORBES INDONESIA

ISSUES & IDEAS

INTREPID mINES

The Tujuh BukiT gold deposit has

reserves possibly around two million

ounces—worth at least $3 billion, along

with significant deposits of silver (80

million ounces) and copper (7 million

ounces). Ownership of that gold mine,

which could become one of the largest

in Indonesia, is at the center of a strug-

gle between two powerful and wealthy

tycoons. The tug-o-war has attracted

lawsuits, investigations, political ma-

neuvering and plenty of controversy.

On one side is the Australia-based and

listed Intrepid Mines and the other

is its former joint venture partner PT

Indo Multi Niaga (IMN).

Into the fray last September

stepped Clayton “Tony” Wenas, 49, as

Intrepid’s executive general manager

for Indonesia. Intrepid chose Tony,

in part, because of his local knowl-

edge and government contacts. We-

nas is currently vice chairman of the

Indonesian Mining Association and a

former executive vice president and

general counsel of PT Freeport. “We

were looking for a prominent resourc-

es business leader who had strong

relationships with various levels of

government and communities,” says

Intrepid’s Chief Executive Brad Gor-

don in emailed comments. “Tony is

right up there with the best.”

Among other tactics, Tony is taking

the battle to the soccer field. This month

he hopes to kick o the company’s first

sponsored soccer event in Banyuwa-

ngi regency, the home of Tujuh Bukit.

Intrepid will pay for a tournament, its

prizes and even the uniforms if needed

by any of the participating teams.

It sounds like a small step, Wenas

admits. But in Indonesia, where rela-

tionships count in business, gestures

like these can make a dierence. “In

Indonesia you have to show people

you care,” says Wenas. Intrepid needs

to win a few hearts and minds. It is

scrambling to raise its profile after

Soccer Diplomacy

Australia’s Intrepid Mines is using soccer

diplomacy and other tactics to regain a stake in

the Tujuh Bukit gold mine, worth billions.

BY JEFFREY HUTTON

Clayton “Tony” Wenas

APRIL 2013 FORBES INDONESIA | 13

“We want to

operate the mine,”

says Wenas. “We

were cheated.

We’re the good

guys in this.”

claiming its joint venture partner IMN

secretly sold out its share to new own-

ers who, in July last year, with the help

of police, forced Intrepid o the devel-

opment in East Java.

In return, last August Intrepid

enlisted the help of media mogul

and potential presidential candidate

Surya Paloh, allocating him 5% of the

company’s shares, which he can sell if

the company’s fortunes improve (he

reportedly also has an option to buy

another 10%). The company is apply-

ing for a local business license and

has asked Indonesian police to help it

regain access to some of its property,

from which it remains locked out.

Aside from a loss of future rev-

enues, Intrepid also stands to lose

nearly A$106 million already spent

over five years through December

2012 developing Tujuh Bukit (also

known as the Seven Hills project). At

present, hopes of winning back Tujuh

Bukit may be fading as the impasse

drags on. In December, Brad and his

chairman, Ian McMaster, said Intrepid

is pursuing IMN through the police,

accusing them of fraud and embezzle-

ment. Intrepid said in a statement to

the Australian stock exchange that

husband and wife Maya Ambarsari

and Reza Nazaruddin transferred 80%

of their company IMN to a subsidiary

called Bumi Sukses Indo with links to

billionaire Edwin Soeryadjaya.

The most recent disclosures show

Maya and Reza are no longer share-

holders of the company which holds

the license to mine Tujuh Bukit. In

an interview with Australian media,

Edwin, while denying any interest in

IMN or Tujuh Bukit, reportedly oered

Intrepid a cut of the mine’s royalties

and what appeared to be a return of the

money spent developing the project.

“We want to operate the mine,”

says Wenas. “We were cheated.

We’re the good guys in this.” IMN

didn’t respond to repeated requests

for interviews. Wenas and Paloh are

trying to win friends where they can.

Toward the end of last year Wenas and

Paloh paid a visit to Banyuwangi for

the opening festivities for the coastal

city’s three-day bicycle race and met

with local leaders. To commemorate

Idul Adha, the Muslim day of sacrifice

last October, when livestock are

slaughtered to distribute meat to the

poor, Wenas had Intrepid deliver six

cows to surrounding villages.

But Intrepid’s and Wenas’s wheel-

ing and dealing may all be too little

too late. The company has lost 90% of

its value since hitting a high in April

2011 around A$2 a share. The current

share price reflects little more than

the A$108 million in cash the compa-

ny has on hand. The company said in

February its loss more than doubled to

A$71.8 million during the 12 months

ended December 31, 2012, compared

with a year earlier.

“Getting Paloh on board, this is stu

they should have down a long time ago,”

says Peter Gray, an analyst with finan-

cial firm Hartley’s in Perth. “It’s been

going on for so long, it’s hard to see how

Intrepid walks away with an interest in

the asset.” Cases like Intrepid’s add to

Indonesia’s risk profile for international

investors. “Considerations of corporate

governance will make Indonesia a hard

sell,” says Bill Sullivan, a lawyer with

law firm Christian Teo Purwono and

partners in Jakarta.

Last year, Canada’s Fraser Insti-

tute’s annual survey of mining com-

panies found Indonesia regulatory

environment had deteriorated for a

fourth consecutive year, ranking ninth

from the bottom as the riskiest place

to explore and mine resources, below

countries such as Niger and Laos.

Under its 2007 agreement with

IMN, Intrepid paid to develop the

mine while IMN managed public and

government relations as well as secur-

ing necessary permits. Once opera-

tional, Intrepid was supposed to reap

80% of the mine’s income. But without

much local presence, the company was

vulnerable—it didn’t even have an of-

fice here until after the July lockout.

“As a foreign investor, don’t give

everything to the local partner. The

foreign investor needs to be involved

in meetings with government ocials

and media,” Wenas says. “Otherwise

they wonder ‘who are you?’ All we

know is IMN.” By Intrepid’s account,

IMN failed to secure a key permit that

allowed foreign companies to operate

domestic mining projects in 2009.

Known as a PMA or Penanaman

Modal Asing, the permit would rec-

ognize foreign ownership of the joint

venture project at Tujuh Bukit. Secur-

ing the PMA was a top priority for

Brad who convened monthly meetings

between the joint venture partners,

according to sources. But even as In-

trepid was shelling out millions every

month, IMN said local issues such as

regional elections and the transition to

a new administration after mid-2010

slowed the approval process.

One way out of the impasse is that

Wenas hints that Intrepid may accept

a lower stake in the project to resolve

the issue, pointing out that under the

agreement Intrepid is entitled to at

least half of Tujuh Bukit. So far, major

shareholders appear to be backing

Intrepid’s current board, if only

because work on the mine is continu-

ing despite the impasse. With plenty of

cash left in reserves Intrepid has

sworn to use it to regain control of

Tujuh Bukit. “I was hired to run a

business,” Wenas says, “But first I have

to be sure I have a business to run.”

F

Surya Paloh Edwin Soeryadjaya

ahmad zamroni / forbes indonesia (2)

14 | FORBES INDONESIA APRIL 2013

PRASETYA MULYA APRIL 2013.indd 2 3/20/13 4:53 PM

APRIL 2013 FORBES INDONESIA | 15

PRASETYA MULYA APRIL 2013.indd 2 3/20/13 4:53 PM

PRASETYA MULYA APRIL 2013.indd 3 3/20/13 4:53 PM

16 | FORBES INDONESIA APRIL 2013

ISSUES & IDEAS — SOCIAL mEDIA

FORBES INDONESIA

LasT year, jakarTa was engrossed in The gu-

bernatorial election, and most pollsters predicted a reelection

for incumbent Governor Fauzi Bowo. A small startup firm

PoliticaWave, founded only in May, chose to be dierent. Two

weeks before the vote, it announced that former Solo mayor

Joko Widodo (Jokowi) would win the election, a prediction

at odds with the conventional wisdom. As the election went

to a second round, PoliticaWave stuck by its prediction. It

turned to be right as Jokowi won 53% of the vote.

The secret to PoliticWave’s accuracy? “We monitor

social media so we can get insights all the time and this

information is continuously updated,” says Yose Rizal, co-

founder and director at PoliticaWave.

PoliticaWave is a joint venture between two

companies: PT Tridaya, owned by Sony Subrata, and PT

Mediawave, owned by Yose. The pair set up PoliticaWave

to monitor social media related to political issues, and uses

its website to publish its findings. Tridaya is engaged with

government relations while Mediawave monitors social

media for companies.

The pair’s success with Jokowi wasn’t a one-o success.

In the recent gubernatorial election in West Java, Politi-

caWave announced that the incumbent Ahmad Heryawan

and running mate Deddy Mizwar would lead the election

with more than 30% of the vote. The final result published

by the General Elections Commission (KPU) were precisely

Vox Populi Online

PoliticaWave’s Sony Subrata and Yose Rizal have tapped social media

to make more accurate political predictions.

BY SONYA ANGRAINI

Sony Subrata (left)

and Yose Rizal.

APRIL 2013 FORBES INDONESIA | 17

While monitoring social media for political

sentiments is common practice in the U.S. and

other countries, PoliticaWave appears to be the

rst to bring this technique to Indonesia.

in line with that forecast. Now the pair are focusing on the

gubernatorial election in Bali, which will be held in May.

The two originally didn’t think of monitoring social

media for political trends, but then had an insight. “If

we could measure what people think about certain

brands, then why don’t we use it for political issues?” says

President Director Sony. Social media is a powerful way

to gauge public opinion as it spreads ideas that influence

political conditions, he adds.

As many know, Indonesia ranks among the world’s top

five countries in the number of Facebook and Twitter ac-

counts. While monitoring social media for political senti-

ments is common practice in the U.S. and other countries,

PoliticaWave appears to be the first to bring this technique

to Indonesia. It monitors not only Facebook and Twit-

ter, but also blogs, forums and other online outlets. Unlike

polls, where respondents may not openly speak, people

are usually quite vocal on social media. “People speak their

minds through this media with great candor,” says Yose.

To measure social media, the pair have developed

tools to rank sentiment, such as how comments are posi-

tive or negative on a candidate. Another challenge in

monitoring social media is to find the right keywords.

“Keywords need to be continuously up-

dated,” says Yose, adding that many use

slang, dialects and languages other than

Bahasa Indonesia. Yose also says one has

to dierentiate between machine-gen-

erated tweets and real ones. “Campaign

managers often use automatic tweets to

increase their tweet amounts. We con-

sider this spam, so we exclude them from

our consideration,” he explains. Anoth-

er challenge is to determine hype from

genuine tweets. “People sometimes send

sensational tweets just to attract follow-

ers. Because of this, many think that our

results are not credible,” says Sony. “But

we do consider these accounts because

we can track their followers and analyze

their opinions.” They have also devel-

oped detailed profiles of various politi-

cians, which are available on the Politi-

caWave website.

Yose says social media is being used

by a wide cross section of the population,

but for now many who are active in social

media are usually educated, and often

from higher income levels. These people

will likely talk about their opinions as

well in their groups, so there will be

amplification, he adds. Sony adds that

even a small percentage of the population using social

media can generate plenty of good data points to analyze.

If, for instance, Internet users are only 10% out of a million

people, that means PoliticaWave has 100,000 samples, Sony

explains. These samples generate much higher numbers

compared to one-on-one surveys, which usually have at

1,000 samples. “We may not have clear identification of the

respondents but the amount of opinion is so big that it can’t

be ignored,” says Sony.

Going forward, PoliticaWave will update its system.

“Now, we can only read results of what is currently

happening. Next, we want to see where the trend is going,”

says Yose. It also plans to provide information for corporate

clients related to political issues in Indonesia and analyze

how this will aect business conditions in Indonesia. It

also plans to provide services for other institutions such as

the Corruption Eradication Commission (KPK) or the

House of Representatives to help them understand the

importance of social media so they can use it as a way to

communicate. “People misunderstand these institutions

and it’s time for them to change that image. Social media is

one way to do so, but if they don’t understand social media,

they won’t be able to do it,” says Sony.

F

PoliticaWave predicted Joko Widodo’s winning in Jakarta’s gubernatorial election, two

weeks before the vote by analyzing social media.

ahmad zamroni / forbes indonesia (left page), afp / getty images

18 | FORBES INDONESIA APRIL 2013

fRESh ThOUghT

TAUfIk DARUSmAN

dip their fingers into the state coers

when no one is looking. As they see it,

no longer is a public ocials’ integ-

rity intrinsic and a given; it must be

questioned along with their academic

background and management skills.

Of course, high-level government

corruption exists all over the world,

even in advanced countries. But what

seems to set Indonesia apart is the in-

credible level of greed in some, if not

most, in high and even low govern-

ment echelons. So it’s not enough, for

example, for a low level tax ocial

as Gayus Tambunan to help himself

to a couple of billions, as is the norm

among ocials in his department. He

had to amass about Rp 74 billion be-

fore the law caught up with him.

By the same token, senior Indo-

nesian police ocial Djoko Susilo

just couldn’t be happy with a house

or two and several plots of lands in

his hometown in Central Java, not to

mention three gas stations and a num-

ber of tourist buses. No mean feat for

someone whose monthly salary is Rp

30 million. He also has apartments in

Australia and Singapore, all of which

the antigraft body KPK alleges could

only have been purchased with funds

acquired by illegal means. And this

involves a person who had sought a

career as a crimebuster.

So how to describe survey respon-

dents who want the nation led by an

“honest and pro-people” ocials?

Hopeless romantics? Unrealistic opti-

mists? Well, perhaps. In the meantime

ordinary people express their disgust

over corruption by using murals and

wall posters to deliver their message.

“God, hopefully my parents are not

corrupt,” depicts one mural in Central

Jakarta, while not far away a poster

says: “I do not wish to have a corrupt

person as my husband.”

Even today the words of the late

prominent Muslim scholar Nurcholish

Madjid still resonates strongly among

the country’s intelligentsia: How do you

reconcile Indonesia as a country with

the world’s largest Muslim population

with it being one of the most corrupt?

No one seems to know or even dare to

seek the answer, as we often find hard

truths dicult to accept.

F

A

recent nationwide sur-

vey says that 47% of

respondents want an

“honest and pro-peo-

ple” person at the helm

of the nation, as opposed to the 1%

who prefer an “intelligent” or the 7%

for a “religious” president. The sur-

vey, conducted by Pusat Data Ber-

satu (PDB, or Center of United Data),

also shows that respondents care less

about the nation’s future leader’s eth-

nic, civilian or military background.

The survey reflects a significant

paradigm shift within our society. For

only a few months ago many surveys

say most respondents prefer a “firm”

leader more than anything else, the

public’s allusion to their weariness of

what it sees as indecisiveness in the

current national leadership.

The survey seems to suggest

that the so-called “Jokowi eect” is

beginning to kick in. Jakarta Governor

Joko Widodo’s (Jokowi) transparent

and pro-people management style

has not only made him a local hero

of sorts; it has also made him the

standard against which government

leaders are measured. For now, the

prevailing conventional wisdom on

leadership here seems to be that

integrity and strong connectivity to

the people matter most.

With daily media coverage on

high-level corruption and on politi-

cians looking much more after their

own welfare rather than that of the

people, it is no surprise that the

public prefer integrity over intelli-

gence in their leaders. By this logic,

it makes no sense having intelligent

people governing the country if they

HARD TRUTH

TAUFIK DARUSMAN IS ONE OF INDONESIA’S MOST EXPERIENCED JOURNALISTS. HE HAS HELD CHIEF EDITOR ROLES AT Business Week indonesia AND investor MAGAZINES,

AND the indonesian oBserver NEWSPAPER.

HIGHLEVEL GOVERNMENT CORRUPTION EXISTS

ALL OVER THE WORLD, EVEN IN ADVANCED

COUNTRIES. BUT WHAT SEEMS TO SET INDONESIA

APART IS THE INCREDIBLE LEVEL OF GREED.

APRIL 2013 FORBES INDONESIA | 19

REALITy ChECk

JAmES kALLmAN

ironically the U.K. is the world

leader in CCTV cameras per capita—

with people quite willing to divulge

personal data online. Moreover, in

addition to voluntary submission of

personal data, detailed profiles are

built up as websites stealthily trace

our tracks across the web.

With all that data out there, it’s

hardly surprising that it has been

investors rather than governments

who have been the first to recognize

the tremendous value of these assets.

The valuation of the likes of Facebook,

Google or Amazon, for instance, are

hard to defend unless one takes into

account these intangible but very real

data assets that don’t appear in books.

However, there have been

stirrings of late and the European

Union launched an initial foray

into the matter of web privacy by

introduction of the EU Cookie Law,

which came into eect last May

and requires websites to request

permission from the user before

planting certain cookies on the user’s

machine. This law seems unlikely to

have much eect, as the wording is

somewhat ambiguous and most just

click their acceptance.

Since then, however, a report was

put out in mid-January at the behest

of the French government, which

raised the idea of taxing the collection

of personal data by Internet firms.

One can appreciate their desire,

as some $2 billion of Google’s $30

billion advertising revenue each year

originates in France, and the French

Treasury receives precious little in

the way of tax revenue.

The belief is growing that per-

sonal data is the fuel for the digital

economy, backed by the number of

businesses being built on the promise

of mining and exploiting ever more

detailed personal data. Given this,

there could be further investigation

into possible ways of taxing the min-

ing of personal data in an appropriate

manner. One suspects, however, that

this step will require international co-

operation, not least in the revision of

accounting standards.

It does appear that the gloves are

o, however, with Google being

threatened with punitive action by

the data protection services of the 27

EU countries should it fail to make

changes to the new privacy policy it

implemented last year. At the end of

the day, though, it all comes down to

how much the individual is prepared

to pay for their privacy.

F

“Civilization works only if those who

enjoy its benefits are also prepared to

pay their share of the costs.”

I

can’t claim credit for the

quote, which came from a re-

cent feature on tax evasion in

the Economist, but it is timely

considering that I was just

working on preparing my annual tax

filing. This quote can be tied to anoth-

er gem I came across, that each day

we are bombarded with as much data

as our ancestors just five centuries

ago received in their whole lifetime.

How much of this is actually neces-

sary for us to lead productive lives may

be debatable, but there can be no doubt

that data is big business nowadays.

The question to be asked, though, is: to

whom does this data actually belong

and do those who enjoy its benefits pay

their share of the costs?

Take social media, for instance.

Nothing has so rapidly empowered

the right of the individual to speak out

and enjoy free speech. Yet this does

not always come without cost, as for

some the use of social media may ex-

pose them to persecution in their own

land, as not all of the world’s citizens

enjoy the same freedom of expression

as in the U.S. and other nations.

Even in more enlightened coun-

tries, however, free speech comes at the

cost of loss of privacy, such as the buzz

of my handphone interrupting a relax-

ing evening with my family. So from

that side of things, I’m certainly paying

for the convenience it aords me.

Nevertheless, we are increasingly

living in an Orwellian world as far

as personal privacy is concerned—

PAYING FOR PRIVACY

JAMES S. KALLMAN IS A SENIOR PARTNER OF GLOBAL ACCOUNTING AND CONSULTING FIRM, MAZARS. A 30YEAR VETERAN OF EMERGING MARKETS, JAMES IS ALSO THE

PARTNERINCHARGE OF MAZARS’ GLOBAL EMERGING MARKETS PRACTICE.

THE BELIEF IS GROWING

THAT PERSONAL DATA

IS THE FUEL FOR THE

DIGITAL ECONOMY.

20 | FORBES INDONESIA APRIL 2013

gLObAL vIEwPOINT

JENNIE S. bEv

this trend. The former is now multina-

tional corporations’ favorite destina-

tion for oshore call centers, while the

latter is for oshore IT desks.

Resource scarcity is another seri-

ous issue to tackle. As more stresses

are placed on the globe’s megacities,

resource scarcity will be more preva-

lent. Increased demand for food, water,

energy, land and natural resources has

been exponentially amplified in an un-

precedented manner. Since 2002, tech-

nological advancement and human

inventiveness is fighting a losing battle

with the law of diminishing returns.

According to forecasts by the IMF

and the World Bank, Asia’s economic

output will be sixfold of today’s, from

$30 trillion to $230 trillion by 2050.

Such an increase in GDP per capita

would impose more stress on global

resources due to intense consumer

consumption. The U.S. Food and

Agriculture Organization also predicts

a 40% deficit between water supply

and demand by 2030.

The third trend is the extreme cli-

mate change that results in a negative

impact on many planetary conditions,

including ocean chemistry, air qual-

ity and climate. The oceans are being

acidified with the nitrogen and phos-

phorus elements in food fertilizers

leaking into bodies of water. Increased

number of automobiles results in in-

creased air pollutants. By 2050, there

will be 3 billion cars worldwide.

Recent worldwide severe winter

storms, for instance, might be caused

by Arctic warming that has shifted

wind patterns. Extreme climate

changes would cause increased food

prices and conflicts as communities

and countries battle for access to

shifting areas of arable land.

Many economists believe that

the world economy isn’t a zero-sum

game because the total sum is much

greater than its parts. However, it is

more realistic to calculate not merely

the present measurable production,

but also the social debts incurring in

the future.

F

This column is the first of two parts, the

second will appear in the May issue.

L

iving in a modern society

involves risks and some

are bigger than others.

In 2020, the world shall

encounter an important

milestone: make it or break it. Accord-

ing to economist Thierry Malleret, by

that year the six global megatrends

will be engendering worldwide in-

stability: unfavorable demographics,

resource scarcity, climate change, geo-

political rebalancing, indebtedness and

fiscal issues, and rising inequalities.

The world population is aging. In

developed and certain Asian countries,

the birth rate is falling. Of course, In-

donesia isn’t included, which is both

a pro and a con. Approximately 4 mil-

lion are born in Indonesia annually,

which is almost the size of Singapore.

Singapore itself is losing population

rapidly, which it attempts to oset

with encouraging immigration poli-

cies and supportive “pro baby” taxa-

tion provisions.

Japan’s labor force started to

shrink in the 1980s, while South Korea

and Taiwan will be losing population

within 15 years. If Indonesia can man-

age its population well with meaning-

ful social and vocational developments,

it has an unprecedented opportunity

to penetrate various job markets in

Asia and, even, worldwide. The trend

of elite “national plus” bilingual and

trilingual K-12 schools is a good start

in cultivating young leaders with an

international attitude. The Philippines

and India have been capitalizing on

2020 MEGATRENDS

AND INDONESIA

IF INDONESIA CAN MANAGE ITS POPULATION

WELL WITH MEANINGFUL SOCIAL AND

VOCATIONAL DEVELOPMENTS, IT HAS AN

UNPRECEDENTED OPPORTUNITY TO PENETRATE

VARIOUS JOB MARKETS IN ASIA.

JENNIE S. BEV IS AN AWARDWINNING AUTHOR, COLUMNIST, AND ENTREPRENEUR BASED IN NORTHERN CALIFORNIA.

APRIL 2013 FORBES INDONESIA | 21

gUEST COLUmN

ERIC LASCELLES

when the global economy is suering

a tepid recovery. As such, it is useful to

evaluate what could go wrong.

Some threats emanate from out-

side the country. Take the possibility

of a sharp decline in commodity pric-

es. Despite the consolation prize of a

suddenly aordable energy subsidies,

Indonesia would nonetheless reel if

the lower commodity prices persisted

for an extended period. A dispropor-

tionate share of growth over the past

several years has been on the wings

of rising commodity prices. Indonesia

could easily find itself growing at just

4% per year instead of the customary

6% if conditions worsen.

Even more alarming would be a

Chinese hard landing. However, this

risk appears small: by all accounts,

China has managed a soft landing to

healthier levels of growth. But China

has plenty of other issues, such as ex-

cessive local government debt. If any

of these issues were to metastasize,

a Chinese hard landing would cast

shrapnel across all of Asia, most tan-

gibly impacting Indonesian exports

and global commodity prices and also

potentially undermining financial con-

ditions and confidence. If there is a

scenario that could take

Indonesia (and the rest

of Asia) back to the mis-

ery of 1998, this is it.

Other risks are do-

mestic in nature, and

within Indonesia’s con-

trol. Inflation is a distinct

risk at a time when the

unemployment rate is at an all-time

low, the current account has dipped

into deficit, minimum wages are ris-

ing quickly and credit is expanding

at a heady pace. Alternately, foreign

investment could prove flighty given

recent protectionist actions in the

mining sector. Indonesia is at risk of

succumbing to the “resource curse”

that turns resource wealth into a mill-

stone around the neck of many de-

veloping nations.

To be clear, none of these risks are

currently likely, and Indonesia’s

prospects remain quite promising. But

the country that neglects to acknow-

ledge its vulnerabilities is the one at

greatest risk of suering from them.

F

I

was recently in Jakarta to

speak at an economic summit

on the potential threats to

Indonesia’s economy. This

proved to be a surprisingly

dicult exercise, as Indonesia has

done much to shield itself from

trouble. To its considerable credit,

Indonesia has managed a remarkable

combination of smooth yet rapid

economic growth for several years,

regularly outpacing its neighbors.

Indonesia has nimbly deflected

any number of threats over the past

15 years. The global crisis of 2008 was

little more than a blip, despite a drop-

o in global demand and commodity

prices. A key source of Indonesia’s

resilience is the flexibility aorded

by a rock-bottom public debt load,

paired with sizeable foreign exchange

reserves. Each is the product of 15

years of fiscal discipline.

A second source of stability is the

diversity of Indonesia’s economy. The

nation’s generous endowment of nat-

ural resources and substantial manu-

facturing sector provide important o-

sets to one another. A large consumer

base provides a more generalized

anchor of stability. Finally, Indonesia’s

relatively small trade orientation of-

fers insulation against foreign shocks.

Of course, Indonesia has taken

some hard lumps. The 1996 Asian

financial crisis still looms large in

the country’s psyche, and avoiding a

repeat of this experience demands

constant vigilance. The margin for

error is particularly small at a time

LOOKING FOR TROUBLE

IN INDONESIA

ERIC LASCELLES IS THE CHIEF ECONOMIST FOR RBC GLOBAL ASSET MANAGEMENT AND SPEAKS ON ECONOMIC TOPICS TO AUDIENCES AROUND THE WORLD.

TO ITS CONSIDERABLE CREDIT,

INDONESIA HAS MANAGED A

REMARKABLE COMBINATION OF

SMOOTH YET RAPID ECONOMIC

GROWTH FOR SEVERAL YEARS.

22 | FORBES INDONESIA APRIL 2013 APRIL 2013 FORBES INDONESIA | 22

10

It was no easy

task to narrow our

choice to these

women—yet the

goal was to provide

selected examples

of role models.

These 10 women

have succeeded in

various endeavors,

and represent

a diversity of

backgrounds. They

show how women

can and do have

a major impact in

whatever is their

chosen profession

or passion. For good

measure, we have

included another 10

on our honor roll.

Regardless of your

gender, it is hoped

that all on these

lists can be a source

of inspiration.

Indonesia

SMAILING TOUR APRIL 2013 EDIT 1 3/11/13 6:25 PM