Forbes USA 28 October 2013 (e-magazine full)

Bạn đang xem bản rút gọn của tài liệu. Xem và tải ngay bản đầy đủ của tài liệu tại đây (20.88 MB, 131 trang )

AMERICA’S BEST BUSINESS SCHOOLS • SILICON ALLEY’S FIRST BILLIONAIRE

-PRENE

U

ER

P

5O

BE

ST

S

NIE

PA

THE

STARTUP

SECRETS

SMALL CAPS

TO BUY NOW

REVENGE OF

WEB 1.0

RS

SU

OCTOBER 28 • 2013 EDITION

O

SMALL C

M

TWITTER CEO

DICK COSTOLO

“BROADCASTERS HAVE

COME TO UNDERSTAND

THAT WE ARE A

FORCE MULTIPLIER.”

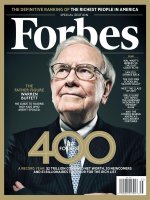

HOW TWITTER

WILL SAVE TV

(AND TV WILL SAVE TWITTER)

THE HYPED IPO LACKS A REAL BUSINESS MODEL.

THE TELEVISION NETWORKS BLEED VIEWERS.

INSIDE THEIR PLAN TO MAKE BILLIONS TOGETHER.

What are you

thinking about?

We’re thinking about your security.

Your business pulls you in a lot of directions. Our job is to think about your

business’s security, no matter where you are. With Tyco Integrated Security’s

Mobile Security Management, you can remotely manage your security

system at any time, from anywhere, on your smart phone, tablet or laptop.

It’s just one reason why we help secure more businesses – of any size – than

any other company. We’re your Tyco Team. And we put security in the

palm of your hand.

For a free Mobile Security demo, visit TycoIS.com/mobile

1.800.2.TYCO.IS / Safer. Smarter. Tyco.™

License information available at www.tycois.com. © 2013 Tyco. All rights reserved.

Tyco is a registered trademark. Unauthorized use is strictly prohibited.

©2013 John Paul Mitchell Systems®

“Growing up, we didn’t have a lot of money, but my mother always grew her own vegetables.

Now we’re bringing generations together...helping thousands of families help themselves with

Grow Appalachia’s community gardens.”

John Paul DeJoria, CEO and Co-founder

THE BEST IN PROFESSIONAL SALON HAIR CARE PRODUCTS

Guaranteed only in salons and Paul Mitchell Schools. paulmitchell.com

contents — octoBeR 28, 2013

VoLUMe 192 nUMBeR 6

70 | king of The Second Screen

It’s prime time for Twitter CEO Dick Costolo.

108 | STarTuP School

An M.B.A. program for budding

entrepreneurs, not I-bankers.

15 | FACT & COmmEnT

by STeve forbeS

Senators: Don’t be easy on the next Fed head.

LEADERBOARD

20 | THE STATE OF BAnkinG

Pay is the only thing that grows in

good times and bad.

23 | SCORECARD

Zuckerberg wins again; Hayne unravels.

26 | CASH AnD CARRIE

Less blood is better for Stephen King movies.

Plus: FORBES Makeover

28 | EvERyTHinG’S JUST FinE

Banks rationalize their bad behavior.

Plus: Up-and-Comers

32 | ACTivE COnvERSATiOn

Bad-boy billionaire Stewart Rahr and the 399 other

members of The Forbes 400.

cover PhoTograPh by eric MilleTTe for forbeS

6 | FORBES OCTOBER 28, 2013

RE:INVEST YOUR CASH WITH A STRONG

ONE-TWO PUNCH.

Turn everyday purchases into investing opportunities.

FREE ATM ACCESS

2% CASH BACK ON EVERY PURCHASE

with the Fidelityă Cash Management debit card1

with the Fidelity American Expressă Card

ã Get automatically reimbursed for all ATM fees

• Rewards automatically deposited into your

Fidelity retirement, brokerage, or college

savings account2

• Free checkwriting and online bill pay

• Free mobile check deposit

See how we can help

your cash work harder for

your Personal Economy.

• No limits on rewards3

«««««

Fidelity.com/Cash

800.FIDELITY

Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

The Fidelity® Cash Management Account (the “Account”) is a brokerage account designed for spending and short-term investing. ATM fees are waived, and reimbursement is

provided for all ATM fees charged by other institutions when you use your Fidelity® Visa® Gold Check Card at any ATM displaying the Visa,® Plus,® or Star® logos. A 1% foreign

transaction fee is not waived and will be included in amounts debited from your Account. The Fidelity® Visa® Gold Check Card is issued by PNC Bank, N.A., and administered by

BNY Mellon Investment Servicing Trust Company.

2

For information about rates, fees, other costs, and benefits associated with the use of the credit card, or to apply, call the number or visit the Web site above and refer to the

disclosures accompanying the online credit application. Customers earn 2 points for each $1 in net retail purchases. Once you reach 5,000 points, they can be redeemed

automatically or on demand for cash at a 1% exchange rate into an eligible Fidelity account (i.e., 5,000 points = $50 deposit). The ability to contribute to an IRA or 529

college savings plan account is subject to IRS rules and specific program policies, including those on eligibility and annual and maximum contribution limits. Additional

restrictions apply. Full details appear in the Program Guidelines new card customers receive with their card. The credit card program is issued and administered by FIA Card

Services, N.A. American Express is a federally registered service mark of American Express and is used by the issuer pursuant to a license. Investment Rewards is a registered

trademark of FIA Card Services, N.A.

3

Certain restrictions apply to each benefit. Details accompany new account materials.

*SmartMoney magazine, June 2010, 2011, and 2012. Industry review ranking leading discount brokers based on ratings in the following categories: commissions and fees, mutual

funds and investment products, banking services, trading tools, research, and customer service.

Fidelity is not a bank and brokerage accounts are not FDIC insured.

Fidelity Brokerage Services LLC, Member NYSE, SIPC. © 2013 FMR LLC. All rights reserved. 646076.1.0

1

contents — octoBeR 28, 2013

THOUGHT LEADERS

82 | SurvivorS—and ThriverS

Three distant memories from the

1990s bubble light up our list of

America’s Best Small Companies.

34 | CURREnT EvEnTS

by Paul johnSon

Obama versus Putin:

Can Obama muster the right stuf?

36 | CApiTAL FLOwS

by naThan leWiS

A stable dollar delivers economic stimulus.

40 | innOvATiOn RULES

by rich karlgaard

Tara’s lesson: Smart leaders copy.

STRATEGiES

42 | DETROiT’S HAppy

HOmE wRECkER

The Pulte family made billions building homes.

Now Bill Pulte is tearing them down.

by joann Muller

46 | THE ApOTHECARy

Three key questions for ObamaCare’s rollout.

by avik roy

98 | Who needS The iPhone?

Even without Apple, InvenSense’s

gyroscope business is pointing

straight up.

TECHnOLOGy

48 | A piCTURE’S wORTH

A BiLLiOn DOLLARS

Jon Oringer turned a side project

into a $2.5 billion photo phenomenon.

by STeven berToni

54 | CHinA’S BLACk BOx

The Chinese answer to Apple TV

is full of pirated content.

by SiMon MonTlake

56 | OnE ADDRESS BOOk

TO RULE THEm ALL

Privacy experts are a little freaked out

about a startup’s self-updating

contact book.

92 | Say cheeSe

Annie’s has the right ingredients

for organic growth.

by adaM Tanner

42 | deMoliTion

Man

A home builder

turns to the

wrecking ball.

26 | Murder

doeSn’T Pay

The Stephen King

Rule: fewer bodies,

more money.

invESTinG

60 | DAy TRADinG GABELLi

ETFs may soon be emerging from

their index fund ghetto.

by ari i. Weinberg

64 | pORTFOLiO STRATEGy

by ken fiSher

Betting against Bernanke.

66 | SmALL STOCkS

by jiM oberWeiS

America’s best small stocks.

68 | yEAR-EnD CHECkUp

by WilliaM baldWin

A Roth conversion formula.

8 | FORBES OCTOBER 28, 2013

contents — octoBeR 28, 2013

BEST SmALL COmpAniES

48 | caMera Man

Oh, snap! Shutterstock’s

Jon Oringer is Gotham’s

frst tech billionaire.

82 | DARwin’S DiGiTAL DARLinGS

Some Web dinosaurs have surged back onto our list

of America’s Best Small Companies.

by naTalie robehMed

92 | miLD inDiGESTiOn

Annie’s has discovered the double-edged

phenom of innovation: new products fuel growth

and nasty competition.

by Meghan caSSerly

98 | THE CHipS ARE Up

A year after a management shakeup InvenSense is

out for a piece of Apple’s business.

by karSTen STrauSS

FEATURES

70 | CAn TwiTTER SAvE Tv? (AnD CAn

Tv SAvE TwiTTER?)

On the eve of its fervently hyped IPO, the

micromessaging service has a radical plan to nab

the ad dollars it needs to thrive: help TV networks

survive the digital media revolution.

by jeff bercovici

102 | THAT SinkinG FEELinG

Carnival has brought a new CEO on board, but

investors are headed for the lifeboats.

by caleb Melby

60 | deSigner fundS

ETFs from your favorite

mutual fund stars.

BEST BUSinESS SCHOOLS

108 | EnTREpREnEUR BOOT CAmp

Austin’s tiny Acton School has one goal: turning

battle-ready graduates into startup successes.

by Michael noer

Plus: The 25 Best Business Schools

BrandVoice

by SaMSung elecTronicS aMerica

Transforming STEm Education One

Community at a Time. 111

116 | TAkEOvER UnivERSiTy

102 | S.o.S.

Carnival’s new skipper may be on a

cruise to nowhere.

A wildly popular Stanford class encourages M.B.A.s

to take control of a real business.

by george anderS

LiFE

122 | THE vinEyARD COLLECTOR

TPG cofounder Bill Price has a plan:

produce wine you can’t buy.

by richard nalley

128 | THOUGHTS

On entrepreneurs.

122 | The good

earTh

Kistler Vineyards stars

in a private equity

prince’s second act.

10 | FORBES OCTOBER 28, 2013

Can you risk less by

reinventing more?

Three out of four new products never make it to market, which makes

some businesses shy away from being innovative. Smarter enterprises

are making trial and error a strength of their development process.

The scalable IBM SmartCloud® is a catalyst for accelerated creativity,

helping some businesses reduce costs by up to 40%.

This is Cloud on a Smarter Planet.

ibm.com/reinvent

IBM, the IBM logo, ibm.com, IBM SmartCloud, Let’s Build A Smarter Planet, Smarter Planet and the planet icon are trademarks of International Business Machines Corp., registered in many

jurisdictions worldwide. A current list of IBM trademarks is available on the Web at www.ibm.com/legal/copytrade.shtml. © International Business Machines Corporation 2013.

FORBES

IN BRIEF

EDITOR-In-CHIEF

Steve Forbes

CHIEF PRODUCT OFFICER

Lewis D’Vorkin

FORbEs MagazInE

EDITOR

Randall Lane

ExECUTIvE EDITOR

Michael Noer

aRT & DEsIgn DIRECTOR

Robert Mansfeld

FORbEs DIgITal

vP, InvEsTIng EDITOR

Matt Schifrin

ManagIng EDITORs

Dan Bigman – Business, Tom Post – Entrepreneurs, Bruce Upbin – Technology and Wealth

sEnIOR vP, PRODUCT DEvElOPMEnT anD vIDEO

Andrea Spiegel

ExECUTIvE DIRECTOR, DIgITal PROgRaMMIng sTRaTEgy

Coates Bateman

ExECUTIvE PRODUCER

Frederick E. Allen – Leadership

Tim W. Ferguson FORbEs asIa

Kerry A. Dolan, Connie Guglielmo, Kashmir Hill sIlICOn vallEy

Janet Novack WasHIngTOn

Michael K. Ozanian sPORTsMOnEy

Mark Decker, John Dobosz, Luisa Kroll, Deborah Markson-Katz DEPaRTMEnT HEaDs

John Tamny OPInIOns

Kai Falkenberg EDITORIal COUnsEl

bUsInEss

Mark Howard CHIEF REvEnUE OFFICER

Tom Davis CHIEF MaRkETIng OFFICER

Charles Yardley PUblIsHER & ManagIng DIRECTOR FORbEs EUROPE

Nina La France sEnIOR vP, COnsUMER MaRkETIng & bUsInEss DEvElOPMEnT

Miguel Forbes PREsIDEnT, WORlDWIDE DEvElOPMEnT

Jack Laschever PREsIDEnT, FORbEs COnFEREnCEs

Michael Dugan CHIEF TECHnOlOgy OFFICER

Elaine Fry sEnIOR vP, M&D, COnTInUUM

FORbEs MEDIa

Michael S. Perlis PREsIDEnT & CEO

Michael Federle CHIEF OPERaTIng OFFICER

Tom Callahan CHIEF FInanCIal OFFICER

Will Adamopoulos CEO/asIa FORbEs MEDIa

PREsIDEnT & PUblIsHER FORbEs asIa

Rich Karlgaard PUblIsHER

Moira Forbes PREsIDEnT, FORbEsWOMan

MariaRosa Cartolano gEnERal COUnsEl

Margy Loftus sEnIOR vP, HUMan REsOURCEs

Mia Carbonell sEnIOR vP, CORPORaTE COMMUnICaTIOns

FOUnDED In 1917

B.C. Forbes, Editor-in-Chief (1917-54)

Malcolm S. Forbes, Editor-in-Chief (1954-90)

James W. Michaels, Editor (1961-99)

William Baldwin, Editor (1999-2010)

Innovations Behind

Our Rising Numbers

by lEWIs D’vORkIn

It’s just a number, but it’s a big one. Last month Forbes.com

hit a record 51 million unique monthly readers as measured

by Omniture, a widely used industry reporting tool. ComScore, another measuring service, puts our worldwide audience at 26 million. By either count the number of monthly

readers has risen more than 200% from three years ago. The

FORBES model for journalism in the digital era disrupts 100

years of traditional media thinking on how to cover the news.

We have a core group of experienced, salaried reporters and

1,200 expert contributors (many part of an incentive-based

program). They’re all building individual brands and communities under the FORBES umbrella brand. Just as unique

is our BrandVoice advertising program. It ofers marketers

the same publishing tools our writers use to create content

and engage with news enthusiasts

in fresh ways. Below are just a few

key product releases that helped

spur the dramatic growth.

50

NOV. 2011

New mobile site goes live in HTML5,

optimizing Forbes for three screens

JULY 2011

Real-time stats

dashboard for

contributors

launches

30

NOV. 2010

BrandVoice

launches with

initial partner,

SAP

OCTOBER 28, 2013 — vOlumE 192 NumBER 6

FORbEs (ISSN 0015 6914) is published biweekly, except monthly in February, April, July, August and October, by Forbes LLC, 60

Fifth Ave., New York, NY 10011. Periodicals postage paid at New York, NY and at additional mailing ofces. Canadian Agreement No.

40036469. Return undeliverable Canadian addresses to APC Postal Logistics, LLC, 140 E. Union Ave, East Rutherford, NJ 07073.

Canada GST# 12576 9513 RT. POSTMASTER: Send address changes to Forbes Subscriber Service, P.O. Box 5471, Harlan, IA 51593-0971.

COnTaCT InFORMaTIOn

For subscriptions: visit www.forbesmagazine.com; write Forbes Subscriber Service, P.O. Box 5471, Harlan, IA 51593-0971;

or call 1-515-284-0693. Prices: U.S.A., one year $59.95. Canada, one year C$89.95 (includes GST). We may make a portion of

our mailing list available to reputable frms. If you prefer that we not include your name, please write Forbes Subscriber Service.

For back Issues: visit www.forbesmagazine.com; email ; or call 1-212-367-4141.

For article Reprints or Permission to use Forbes content including text, photos, illustrations, logos, and video:

visit www.forbesreprints.com; call PARS International at 1-212-221-9595; email or email

Permission to copy or republish articles can also be obtained through the Copyright Clearance Center at

www.copyright.com. Use of Forbes content without the express permission of Forbes or the copyright owner is expressly prohibited.

Copyright © 2013 Forbes LLC. All rights reserved.

Title is protected through a trademark registered with the U.S. Patent & Trademark Ofce. Printed in the U.S.A.

12 | FORBES OCTOBER 28, 2013

SEPT. 2013

Intelligent

scrolling

40

streams

MAY 2010

Forbes acquires

True/Slant

2010

JAN. 2013

FORBES

magazine app

launches

JUNE 2012

New home page,

following functionality;

1000 contributors publish

8200 posts/month

2011

2012

2013

MONTHLY UNIqUE VISITORS (IN MILLIONS)

20

10

© 2013 Citigroup Inc. Citi and Citi with Arc Design are registered service marks of Citigroup Inc. The World’s Citi is a service mark of Citigroup Inc.

THE

WORLD’S

CITI. IT’S

WHEREVER

YOU ARE.

It isn’t New York or London

or Beijing. It’s not Lagos or

São Paulo or Dubai. Today,

it’s wherever you are.

Wherever you bring your

ideas, drive, passion and

a hope that someone will

believe in you. What if a bank

made that its job? Wherever

people come together to

create or build something,

we’re there to help make

it real. For over 200 years.

Around the world.

citi.com/progress

FORBES

FACT & COMMENT — STEVE FORBES

“With all thy getting, get understanding”

SEnaTORS: dOn’T BE EaSy

On ThE nExT FEd hEad

BY STEVE FORBES, EDITOR-IN-CHIEF

When President Obama

takes time out from stonewalling

congressional Republicans over

the continuing budget resolution

and raising the debt ceiling to pick

a nominee for the next Federal

Reserve chairman, the U.S. Senate

should be prepared to ask that candidate hard, critical questions and

to reject the person if satisfactory

answers aren’t forthcoming.

To “stimulate” the economy our

central bank, at the direction of Ben Bernanke,

has undertaken unprecedented actions that

have immensely harmed credit markets, thereby

retarding recovery. They have the potential to

infict even greater damage on us and the world

than the 2008–09 crisis. Without congressional

authority the Fed has assumed enormous economic powers. Even worse, despite the Fed’s

manifest failures before and after the economic

crisis, Congress has granted it other powers that

threaten our economic future. The Fed houses

the Consumer Financial Protection Bureau,

which wields almost unbridled authority over

banks and fnance companies regarding mortgages, credit cards and other lending activities, and gives it whatever funds it wants. The

bureau has no real accountability to Congress,

which is why it can hire like crazy at a time of

supposed federal budget tightness and lay out a

reported $95 million in “ofce renovations.”

Senators, whose job it is to confrm or reject

the President’s nominee, will be highly reluctant

to do anything other than go through the motions

in the aftermath of the current circus. Republicans in particular won’t want to be accused of

“playing politics” with such a critical, sensitive

post. But this is the time for statesmanship.

Monetary policy is that peculiar

subject that intimidates most people.

It’s not because of its complexity; the

basics are simple. And, though it may

be impossible to believe these days,

there are plenty of people in Congress who can master arcane, difcult

matters. But, strangely, the psychology of monetary policy strikes anxiety

and trepidation into the hearts of

most. However, given the crucial

importance of the Fed right now, this

fear must be overcome for the sake of the country.

The nominee must be grilled hard regarding

how he/she plans to unwind the Fed’s promiscuous bond buying. The central bank’s recent

botched attempt at “tapering” demonstrates

how difcult this will be. Much of Wall Street is

addicted to the process, as stock and bond gyrations during the “tapering” fasco attest. When it

comes to bond prices, unwinding is going to be

rough. Markets try to anticipate the future, and if

traders and investors think more normal interest

rates are coming down the road, they will mark

the value of bonds down now, not gradually.

Never before in history has an important

central bank done what ours has done: loaded up

on long-term government bonds and mortgages

by borrowing short-term money from banks.

Bernanke & Co. have bought hundreds of billions

of Treasury bonds at premiums from par. That is,

they are paying, say, $1,200 for a bond that was issued at $1,000—which is what happens when you

suppress long-term interest rates. Noted economist and FORBES columnist David Malpass calculates that these premiums now exceed $200 billion

and should be added to our nation’s debt.

This raises other obvious questions for Obama’s

pick: Why shouldn’t these excesses be part of the

OCTOBER 28, 2013 FORBES

| 15

ACURA.COM / MDX

MDX with Advance Package shown. Learn more at Acura.com or by calling 1-800-To-Acura. ©2013 Acura. Acura and MDX are trademarks of Honda Motor Co., Ltd.

ADDING

BUTTONS

ISN'T

INNOVATION,

REMOVING

THEM

IS

FORBES

debt, and who gave the Fed the authority to add to the national debt without

congressional approval? The debt

ceiling was exceeded before our Treasury Department acknowledged it.

Quantitative easing upended

American credit markets, just as

rent control does with local housing

markets. QE limited the availability

of credit for nonfavored borrowers.

Under QE the federal government

fnances defcits without tears.

Washington pays barely any interest

on its new borrowings, and, thanks

to the Fed, it can borrow as much

as it wants until the debt limit is

reached—at which point Congress

always raises the ceiling.

Big companies also have easy access to credit, one reason that their

balance sheets have never been stronger. The housing market has benefted

from massive, ongoing purchases

of hundreds of billions of dollars

in mortgage-backed securities. But

smaller, job-creating businesses have

sufered because of limited access to

credit. Only recently has there been

a better fow of credit to this crucial

part of our economy, thanks, in part,

to a wonderful American characteristic—when something is blocked,

entrepreneurs fnd ways to get around

it. Numerous nonbank sources for

credit to smaller businesses, including

equity funds, are starting to fll the gap.

Who gave the Federal Reserve the

authority to allocate credit?

Another important question: Why

has one-third of the Fed’s bond-buying

since the downturn remained at the

Fed instead of being put to work in

the economy? This strange pattern

has been evident for several years.

Why hasn’t the central bank addressed this matter? One big factor is

that regulators pressured banks not

to lend except to the federal government. This was done to improve

bank balance sheets. But this caution

clearly went too far.

Now that we have this massive

overhang, what’s to prevent a return

18 | FORBES

OCTOBER 28, 2013

to 1970s-style infation?

In 2008 the Fed was given permission to pay interest on reserves. Did

this help block the fow of credit to

smaller businesses? Has the Fed conducted any studies regarding this? If

not, why not?

What real-world evidence is there

that quantitative easing here and

Vice Chairwoman of the Federal reserve

Janet Yellen, who likes an ultraweak dollar, is

favored to succeed Ben Bernanke.

elsewhere has actually stimulated

economic growth? Never before in

U.S. history has there been such a

punk recovery after a sharp downturn—and that includes the Great

Depression. A severe contraction

has always been followed by a sharp

upturn. The question then becomes

whether the upswing can be sustained. In the 1930s it could not.

When the Fed tapers again what’s

to prevent a repeat of the 1997–98 Asia

crisis? We got a taste of what could

happen with the brief tapering this

year. The anticipation of higher rates in

the U.S. led to an outfow of funds from

such emerging and middle-income

countries as Brazil, India and Indonesia

and to attacks on their currencies.

This is a vitally important issue.

Too often central banks don’t know

how to defend their currencies. The

frst thing a government must do is

announce unequivocally that it will

defend its money. Next it must raise

interest rates to underscore that

intent. Then it must aggressively buy

its currency in foreign exchange markets with its reserves, usually dollars

(other currencies, such as the euro

and yen, as well as gold, make up the

rest of a country’s reserves). Done

right, this last step will decisively end

any assault on the integrity of the

currency. However, where a central

bank too often falters is in reducing

the size of its monetary base, which

is made up of the currency in circulation and domestic bank reserves.

Here’s what happens. A central

bank buys its currency with dollars—

which is good—but it then promptly

puts that money back into its domestic economy by, most likely, buying its

government debt. What the central

bank took away with one hand has

been given back with the other; the

monetary base remains unchanged.

All that’s happened is that the central

bank has reduced its reserves—and

done it for nothing. Economists call

the process “sterilization.”

This self-defeating exercise happens time and time again. Look at

Thailand in 1997, when the economic

crisis in Asia began. Bangkok had

ample reserves, almost $40 billion. At

the time its currency, the baht, was

fxed to the dollar at roughly 25 bahts

to the dollar. When the baht began to

weaken, the Bank of Thailand should

have reduced its monetary base by

using dollars to buy bahts in foreign

exchange markets. Thailand had

enough dollars to buy its entire monetary base twice over. Instead it engaged in sterilization. It ran down its

reserves and then let the baht “foat,”

which sent it into a free fall.

One country that didn’t fall into

the sterilization trap during the

fnancial crisis of 2008–09 was Russia. When the ruble came under

assault the Bank of Russia initially

responded the conventional sterilization way. Then in early 2009, after an

op-ed piece by monetary expert and

FORBES columnist Nathan Lewis

appeared in Pravda, Russia reversed

course, reducing its monetary base.

Result: The ruble strengthened, the

speculators were routed and the crisis

ended with the ruble triumphant. F

Andrew HArrer/BloomBerg

FACT & COMMENT — STEVE FORBES

Handling $421 billion in accounts payables annually.

Made simple by Xerox.

Today’s Xerox is simplifying the way work gets done in surprising ways. Such as managing global finance, accounting and

procurement operations for customers across the entire order-to-cash life cycle. All delivered as scalable solutions designed

to help you achieve measurable process efficiencies and cost savings in both the short and the long term. It’s one more

way Xerox simplifies business, so you can focus on what really matters.

RealBusiness.com

â2013 Xerox Corporation. All rights reserved. Xeroxđ Xerox and Design® and Ready For Real Business®

,

are trademarks of Xerox Corporation in the United States and/or other countries.

LEADERBOARD

KEEPING SCORE ON WEALTH & POWER

2.150 M

2.046 MIL EMPLOYEES

$60,883 SALARY/EMPLOYEE

1.41

ROAA%

1.3

1.33

INDUSTRY ATLAS

THE STATE

OF BANKING

$65,608

2.097 M

$60,724

THANKS TO the government, U.S. banks are

back on a solid footing. Return-on-averageassets, shown in the center of each bubble,

and stock prices have rebounded impressively

since the depth of the financial crisis. But trillions in stimulus spending has done little to

revive banks’ core mission—lending money—

with the ratio of loans to deposits still falling.

The only thing that has consistently grown, in

good times and bad, is bankers’ pay, represented by the ever-expanding colored circles.

$12 Trillion

10

1,200%

100%

SNL U.S. BANK AND

THRIFT INDEX

TOTAL RETURN

GROWTH OF LOANS

AND DEPOSITS IN

U.S. BANKS AND THRIFTS

1,000

80

8

800

60

6

4

600

40

Loans (left scale)

Deposits (left scale)

Loans/deposits (right scale)

400

20

2

2003

’05

’07

’09

’11

’13

200

2003

’05

’07

’09

’11

’13

SOURCE: SNL FINANCIAL.

2003

20 | FORBES OCTOBER 28, 2013

2004

2005

2006

1.5

COMPENSATION PER

BANK EMPLOYEE

2.205 M

+90K

1.37

80–90K

$91,694

70–80K

$68,987

60–70K

1.2

2.213 M

$87,893

1.11

$72,282

1.02

$84,217

.94

0.9

.91

2.097 M

2.108 M

$80,971

2.089 M

2.108 M

.65

0.6

2.150 M

0.3

$72,434

.13

$79,767

2009

2007

2008

2010

-.10

0

2011

2.061 M

2012

2013

OCTOBER 28, 2013 FORBES | 21

Answering 1.6 million customer interactions a day.

Made simple by Xerox.

Today’s Xerox is simplifying the way work gets done in surprising ways. Such as helping companies manage

their customer care operations, help desks and online support. Giving you access to timely, scalable and

cost-effective call center solutions in any language, anywhere around the world. It’s one more way Xerox

simplifies business, so you can focus on what really matters.

RealBusiness.com

©2013 Xerox Corporation. All rights reserved. Xerox® Xerox and Design® and Ready For Real Business®

,

are trademarks of Xerox Corporation in the United States and/or other countries.

LEADERBOARD

$53 MILLION

The civil penalty Ty Warner must pay

in his federal tax-evasion case.

SCoRECARD

WINNERS

Mark

Zuckerberg

Jef

Bezos

Phil

Knight

scorecard by scoTT decarLo; new biLLionaires by aLex morreLL

ZUCKerberg: ANDrew hArrer/bloomberg; beZoS: t.J. KirKpAtriCK/bloomberg; AriSoN: JohN pArrA/getty imAgeS; hAyNe: george wiDmAN/Ap; wArNer: ChriS hoNDroS/getty imAgeS

+$4.7 billion

+$2.6 billion

+$1.3 billion

Net worth:

$23.5 billioN

Net worth:

$29.8 billioN

Net worth:

$17.7 billioN

As wall Street’s infatuation

with Facebook continues

and the stock keeps rising,

Zuckerberg makes his

fourth straight appearance

as a big gainer.

Amazon trades at an

alltime high as it introduces

three new Kindle Fire

models, while its founder

ofcially takes control of

the Washington Post.

Nike’s stock soars after

the company posts

impressive quarterly

earnings and is made

part of the Dow Jones

industrial average.

nEW billionAiRE

LOSERS

Micky

Arison

INSYS’

JOHN KAPOOR

Richard

Hayne

Ty

Warner

–$560 million

–$180 million

Guilty

Net worth:

$5.3 billioN

Net worth:

$1.6 billioN

Net worth:

$2.7 billioN

his holdings in Carnival,

the world’s largest cruise

company, tank with lower

quarterly earnings and

weak bookings—see “that

Sinking Feeling,” p. 102.

Urban outftters, which

he cofounded in 1970,

falls 10% in a day after the

company reports weak

sales and fails to meet

analysts’ forecasts.

the beanie babies founder

faces up to fve years in

prison after pleading guilty

to federal tax evasion for

hiding millions of dollars in

a Swiss bank account.

stock of his pharmaceutical company,

Insys Therapeutics, has quintupled since

its May IPO, catapulting him to billionaireship at 70. Insys produces drugs to alleviate

cancer patients’ symptoms; he’s its founder

and executive chairman, and his stake is

now worth more than $600 million. He also

owns more than $400 million of drugmaker

Akorn. The frst member of his family to go

to college, he arrived in America from India

in 1964. His career took of when he joined

LyphoMed, a struggling pharma company, in

1978, worked his way up to general manager,

turned the business around and sold his

share of it in 1990 to net $100 million. He has

been a serial entrepreneur ever since. “This

is the country you can do it in. Nowhere

else,” he tells FORBES.

FigUreS reFleCt the ChANge iN VAlUe oF pUbliCly trADeD holDiNgS From AUg. 23 to oCt. 2.

SourceS: InteractIve Data vIa FactSet reSearch SyStemS; ForbeS.

october 28, 2013 ForbeS | 23