principle of accounting group assignment

Bạn đang xem bản rút gọn của tài liệu. Xem và tải ngay bản đầy đủ của tài liệu tại đây (1.68 MB, 22 trang )

<span class="text_page_counter">Trang 1</span><div class="page_container" data-page="1">

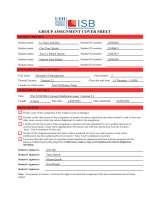

<b>Principle of Accounting Group Assignment </b>

<b>Instructor: Nguyễn Hoàng Yến Như </b>

</div><span class="text_page_counter">Trang 2</span><div class="page_container" data-page="2"><b>Principles of Accounting Group member’s Contribution form </b>

<b>B. Summary of the accounting cycle……….3 </b>

<b>C. Description of the accounting cycle………..5 </b>

<b>D. General Journal and Ledger……….8 </b>

<b>E. Unadjusted Trial Balance, Adjustments, and Adjusted Trial Balance…….14 </b>

<b>F. Financial Statements……….16 </b>

<b>G. Closing Process………..18 </b>

<b>H. Analysis and Conclusion………..20 </b>

<b>I. Conclusion……….22 </b>

</div><span class="text_page_counter">Trang 3</span><div class="page_container" data-page="3">

<b>A. Business Introduction </b>

The Vietnamese pastry market is one of the fastest growing in Southeast Asia. With a large and young population, Vietnam is a strongly competitive segment in the field of consumer goods. This has created an attractive startup area for Gen Z. “The Vietnamese pastry market is one of the fastest growing in Southeast Asia and still has strong potential for continued growth. This market is chasing the latest technologies to keep pace with global trends.” (Kao Sieu Luc, General Director of ABC Bakery, October 16, 2019). However, for the bakery industry, starting a business is even more difficult because the number of bakeries increases weekly and monthly. Competition is increasing, so it is necessary to have a suitable business roadmap, and short-term and long-term plans, to avoid getting lost and not finding the right direction in the pastry business.

After careful consideration and calculation, we decided to open a cake distribution shop with an investment of 1.5 billion VND. The company officially came into operation on January 1, 2022. Deli - Company is a company specializing in the distribution of cakes in the Vietnamese market. The target audience is large and small pastry shops and people with large demand for cakes nationwide. During its operation, the company constantly looks for new sources of raw materials and creates many different kinds of cakes. Our company always strives to do that with the desire to meet the needs of the market and consumers.

However, getting started as a bakery distributor requires a significant capital investment and a certain level of expertise in sales, production, and management. Because this is the first year of the company's establishment and operation, it is inevitable that there will be shortcomings. Our report (Deli-CompanyTM) will analyze the strengths and weaknesses of the cake distribution business, report the business activities and prepare the company's first year financial statements.

<b>B. Summary of the accounting cycle </b>

Our accounting cycle consists of 9 basic steps

<b>- Step 1: Analyze transactions: Here we have recorded all transactions affecting the company's </b>

finances. It helps us to see how a company's business transactions affect its assets, liabilities,

</div><span class="text_page_counter">Trang 4</span><div class="page_container" data-page="4">the table below.

- <b>Step 2</b>: General Journal: In the general journal, each transaction is recorded with a journal entry, with the transaction date, transaction description, affected accounts, and debit and credit amounts. It is an important tool for companies to easily and accurately track their financial transactions. From there, it helps to make financial reporting more effective. In our general

<b>journal, total debits equal to total credit is 4,342,973,333 VND. </b>

<b>- Step 3: General Ledger: We use the T-account method to record relevant data. </b>

- <b>Step 4</b>: Prepare unadjusted trial balance: Ensuring that the debits and credits in the general ledger are equal is the main purpose of the unadjusted trial balance. In addition, it also helps the company to avoid errors (if any) in the accounting records before making adjustments. The unadjusted trial balance shows that total debits and credits equal <b>2,251,123,333 VND. </b>That shows that the company has made the right decision in financial recognition.

- <b>Step 5</b>: Adjustment: Adjusting entries are necessary to accurately reflect certain transactions or events that have occurred but have not yet been recorded. These entries include accruals for revenues or expenses that have been earned or incurred but have yet to be recorded, as well as deferrals for revenues or expenses that have been recorded but relate to a future accounting period.

At the end of the period, Deli made the following adjustments

a. An analysis of the company insurance policies shows that VND of coverage has 1 year expired.

b. An analysis of prepaid rent policies shows that VND of coverage has 1 year expired. c. An inventory count shows that merchandise costing 44 million VND is available on Feb

28.

d. The company purchased equipment on January 1, 2022. It cost 500 million VND and is expected to have a 200 million VND salvage value at the end of its predicted 5-year life. e. On June 1, the company agreed to provide cakes in the eight-month course (starting

immediately) for a Yum bakery. The contract calls for a monthly fee of 6,1 million, and Yum Bakery paid the first seven months’ fees in advance. When the cash was received, the Unearned cake fees account was credited.

f. The company will pay employees on the 5th of each month. December 5 falls on a Monday, December 31 falls on Saturday, and January 5, 2023 falls on Thursday. The company paid 15 million VND in cash for 3 months. The company hired 3 employees g. Adjust transaction from June 1.

</div><span class="text_page_counter">Trang 5</span><div class="page_container" data-page="5">trial balance is prepared to show the updated account balances. This adjusted trial balance is used to prepare the financial statements. In our adjusted trial balance, total debits equal to total

<b>credit is 2,314,123,333 VND. </b>

<b>- Step 7: Prepare statements: Use adjusted trial balance to prepare financial statements. The </b>

income statement shows the company's revenues and expenses for the accounting period,

<b>resulting in net income or net loss, so net profit is 105,093,333 VND. The balance sheet presents </b>

the company's assets, liabilities, and equity at a specific point in time. In our balance sheet, total

<b>assets equal to total liabilities and equity is 1,593,600,000 VND. </b>

<b>- Step 8: Closing process: At the end of the accounting period, temporary accounts, such as </b>

revenue, expense, and dividend accounts, are closed to the retained earnings account. This involves transferring their balances to the appropriate account to reset the balances for the next accounting period. After closing entries, total capital is <b>1,455,093,333 VND. </b>

- <b>Step 9</b>: Prepare post-closing trial balance: After the closing entries have been made, another trial balance is prepared to ensure that the debits still equal the credits and that all temporary accounts have been closed. This post-closing trial balance serves as the starting point for the next accounting period. <b>Total debits equal to total credit is 1,593,600,000 VND. </b>

<b>C. Description of the accounting cycle </b>

After several months of planning, Deli Company was officially established. The following transactions occurred during the first year of operation:

1 January 1 Naomi invested 1 billion VND in cash and equipment worth 500 million VND in the company.

2 January 5 The company prepaid rent of 192 million VND for 2 years of operation.

3 January 15 Purchased merchandise from Nhat Huong bakery for 60 million VND on credit term of 2/10, n/30, FOB destination.

4 January 25 The company paid 20 million VND in cash for advertising.

</div><span class="text_page_counter">Trang 6</span><div class="page_container" data-page="6">month insurance policy.

6 February 8 Paid Nhat Huong the amount due from Jan 15.

7 February 15 Sold merchandise to The Bunny Coffee for 52 million VND by cash. The merchandise cost 15 million VND.

8 March 8 Sold chocolate (merchandise) for Rang Rang coffee for 60 million VND on credit terms 2/10, n/60, FOB destination. The merchandise cost 20 million VND.

9 March 8 Shipping costs 500 thousand VND.

10 March 31 The company pays the salary for 2 months of working for 3 employees is 30 million VND.

11 April 5 Rang Rang returned merchandise from the Mar 8 sale that had cost Deli Company 10 million VND and had been sold for 15 million VND. The merchandise was restored to inventory.

12 April 30 Received Rang Rang’s cash payment for the amount due from Mar 8.

13 May 15 Purchased merchandise from Nhat Huong bakery for 100 million VND on credit terms of 2/10, n/30, FOB destination.

14 May 20 The company received on credit 40 million VND from the customer for orders on 31 May.

15 May 25 Paid Nhat Huong Company the amount due from May 15.

16 May 31 Return goods to customers on May 31 and receive 40 million VND in cash.

17 June 1 The company supplies cakes to an elementary school to celebrate International Children's Day with 350 million VND in cash in a year.

18 June 30 The company pays the salary for 3 months of working for 3 employees is 45 million VND.

</div><span class="text_page_counter">Trang 7</span><div class="page_container" data-page="7">FPT university school, term n/30.

20 July 25 Sold 60 million VND of cakes (that had cost 22 million) on credit to Y9 coffee shop, 2/10, n/30, FOB destination.

21 August 15 Accepted a 100 million VND, 9%, 90-day note dated this day in granting a time extension on the past-due account receivable from FPT University.

22 August 28 Wrote off the Y9 account against Allowance for Doubtful Accounts.

23 September 1 Purchased merchandise from Nhat Huong bakery for 100 million VND on credit terms of 2/10, n/30, FOB shipping point. Deli Company paid 250 thousand VND to Express Shipping for delivery charges on the merchandise.

24 September 10 Paid Nhat Huong Company the amount due from Sep 1.

25 September 31 The company pays the salary for 3 months of working for 3 employees is 45 million VND.

26 October 3 Sold 120 million VND of cakes (that had cost 35 million VND) on credit to Duc Phat bakery, term n/30.

27 October 31 Paid 1,5 million VND in cash for utilities.

28 November 2 Accepted a 120 million VND, 6%, 30-day note dated this day in granting a time extension on the past-due account receivable from Duc Phat bakery.

29 November 13 Received payment of principal plus interest from FPT University for the Aug 15 note.

30 December 2 Duc Phat Bakery refuses to pay the note due to Deli Company on Nov 2. Prepare the journal entry to charge the dishonored note plus accrued interest to the Duc Phat bakery account receivable.

</div><span class="text_page_counter">Trang 8</span><div class="page_container" data-page="8">34 December 31 The company must pay corporate tax 20% of total profit.

<b>D. General Journal and Ledger </b>

D.1 General Journal

<b>Deli Company General Journal </b>

</div><span class="text_page_counter">Trang 12</span><div class="page_container" data-page="12">Jan 1 1,000,000,000 192,000,000 <b>Jan 5 Mar 8 </b> 60,000,000 15,000,000 Apr 5 Feb 12 52,000,000 20,000,000 <b>Jan 25 May 20 </b> 40,000,000 45,000,000 Apr 30 Apr 30 45,000,000 120,000,000 <b>Feb 1 Jul 16 </b> 100,000,000 40,000,000 May 31 May 31 40,000,000 60,000,000 <b>Feb 8 Jul 25 </b> 60,000,000 100,000,000 Aug 15 Jun 1 350,000,000 500,000 <b>Mar 8 Oct 3 </b> 120,000,000 60,000,000 Aug 28 Nov 13 102,250,000 <b>30,000,000 Mar 31 Dec 2 </b> 120,600,000 120,000,000 Nov 2

<b> Jan 5 192,000,000 Merchandise inventory Balance 192,000,000 </b>

</div><span class="text_page_counter">Trang 13</span><div class="page_container" data-page="13">Apr 5 10,000,000 20,000,000 <b>Mar 8 Prepaid insurance </b>

May 15 100,000,000 40,000,000 <b>Jul 16 Feb 1 120,000,000 </b>

Sep 9 100,000,000 22,000,000 <b>Jul 25 Balance 120,000,000 </b>

2,000,000 <b>Sep 10 </b>

26,273,333 <b>Dec31 </b>

<b>26,273,333 Balance 432,000,000 Balance </b>

</div><span class="text_page_counter">Trang 14</span><div class="page_container" data-page="14"><b>and allowances </b>

1,500,000,000 <b>Jan 1 Aug 15 </b> 100,000,000 100,000,000 Nov 13

<b>1,500,000,000 Balance Nov 2 </b> 120,000,000 120,000,000 Dec 2

<b>E. Unadjusted Trial Balance, Adjustments, and Adjusted Trial Balance </b>

A trial balance is used to confirm that the total debit account balance is equal to the total credit account balance at a point in time or is it a list of accounts ad their balances at a point in time (Wild, J., Shaw, K. and Chiappetta, B., (2010). Fundamentals accounting principles. 20th ed.

</div><span class="text_page_counter">Trang 15</span><div class="page_container" data-page="15"><b>of 2022 both on the debit side and the credit side with the total account column is 2,314,123,333 VND. </b>

<b>Deli Company Worksheet </b>

<b>Unadjusted Trial Balance Adjustment Adjusted Trial Balance </b>

</div><span class="text_page_counter">Trang 17</span><div class="page_container" data-page="17"><b>For year ended Dec 31, 2022 </b>

</div><span class="text_page_counter">Trang 18</span><div class="page_container" data-page="18"><b>Deli Company Balance Sheet Dec 31, 2022 </b>

</div><span class="text_page_counter">Trang 20</span><div class="page_container" data-page="20">150,000,000 1,500,000,000105,093,333

<b>❖ Profitability Ratios: </b>

Gross Profit Margin = (Sale - Cost of Goods Sold) / Sale

= (675,616,667 123,000,000) *100/ 675,616,667 <b> - </b>

= 81.79% Net Profit Margin = Net Profit / Net sales

= (105,093,333 / 660,616,667)*100 =15.91%

Return on Assets (ROA) = Net Income / Total Assets

</div><span class="text_page_counter">Trang 21</span><div class="page_container" data-page="21">= 6.59%

Return on Equity (ROE) = Net Income / Shareholders' Equity = 105,093,333 / 1,455,093,333 = 7.22%

The company's gross profit margin is 81.79%, which is quite high. That shows that the company has the ability to distribute its goods without losing too much in the production and supply process.

Net profit margin is at a high level with a specific figure of 15.91%. Thereby, we also see that the company's financial strength is stable, not depending on debts to do business too much.

Debt-to-asset ratio of the company is low at 7.04%. This is a good sign, showing that the company uses less debt than its assets. At the same time, the company has good debt management ability.

The debt-to-equity ratio of the company is low at 7.71%. This shows that the company is using its equity more than debt. Thereby, we also see that the financial strength of the company is at a stable level, not depending on debts to do business too much.

</div><span class="text_page_counter">Trang 22</span><div class="page_container" data-page="22">requirements.

Overall, Deli-Company offers an attractive opportunity for aspiring entrepreneurs in the bakery industry. With careful financial planning and effective strategy execution, the company sees great potential for success and growth in this business.

<b>Reference list: </b>

Wild, J., Shaw, K. and Chiappetta, B., (2010). Fundamentals accounting principles. 20th ed.

<b>Hill Higher Educa: McGraw-Hill/Irwin </b>

Thị trường bánh ngọt Việt Nam tăng trưởng nhanh. (2019, October 22). Gapping World. Retrieved July 11, 2023, from

</div>