IT training visual merchandising and retail design TruePDF january 2019

Bạn đang xem bản rút gọn của tài liệu. Xem và tải ngay bản đầy đủ của tài liệu tại đây (21.76 MB, 64 trang )

IN

S

er

od

fM

it o

A

un

9/4

,

The mannequins shown above are protected worldwide under IPR Laws in the name of above principles.

Any unauthorized use of the same is an offence under the law

D-

Mumbai Ofce - Ph: 022 24378548, 24220295

Mobile: +91 9819739853, Email:

Kolkata Ofce - Ph: 033 40086955

Mobile: +91 9831033844, Email:

C

LO

M N

A E

IN NN

C EQ

.

U

Mannequins I Display Dummies | Dress Forms I Jiffy Steamers I Wooden Hangers I Display Accessories I Any Customized work

nA

Ph Ok

rtis

hla

as

tic

Ha

eI

n

nd

I

d

I

icr

,

us

EN

aft

tria

ma

ew

s

lA

il:

D

e

c

r

e

l

l

Te

h

o

a,

l: + ne@ i –

11

91

c

0

Fa -11 lone 020

-4

x:

ma

+9 066

nn

14

eq

0

11

uin

-4 00

06

s.c

64

om

00

1

Courtesy: Hans Boodt Mannequins

What’s in-store

for 2019?

Another year has rolled in

and going by the pace of it,

it looks like another furiously

galloping year that is likely

to leave us breathless by the

year-end wondering “how did

the year go by so fast?”

Visual Merchandising & Retail Design

Volume 14

Issue 4 January 2019

EDITOR & PUBLISHER

SR. ASSOCIATE EDITOR

ASSOCIATE EDITOR

SR. REPORTER

DESIGNER

I don’t know about you, but

for us at VM&RD it is certainly

going to be a relentlessly hectic first quarter, what with the

12th edition of the much awaited In-Store Asia 2019 event

coming up in March in Mumbai during 14th-16th.

Vasant Jante

N. Jayalakshmi

Satarupa Chakraborty

Smita Sinha

Vinod Kumar. V

CIRCULATION / EDITORIAL OFFICE

#1019/2, 1st Cross, Geetanjali Layout, New Thippasandra, Bangalore-560 075.

Tel : 91-80-40522777 / 25294933

Email: www.vjmediaworks.com

Mumbai Office

201, 2nd Floor, Krishna Commercial Centre, 6 Udyog Nagar,

Nr. Kamat Club S.V.Road, Goregaon (W), Mumbai - 400 062.

Tel: 022-40234446

Regular visitors to ISA know that we always manage to

serve a versatile fare of business-driving Expo, thought

provoking Convention and talent recognizing Awards.

And this year also we have a very interesting line-up of

speakers who will be sharing their insights and experiences

related to various aspects of retail design and in-store

communication. Do check out our special article to know

about our speaker line-up for ISA 2019.

ISA is also a platform for the industry and their clientele (the

brands and the retailers) to come together and discuss the

way forward – whether it is about relooking the whole eco

system, initiating a new design thought process or working

out a way to beat the challenges facing the industry today.

Delhi Office

E-24,2nd floor, Naraina Vihar, New Delhi-110 028, India.

Tel: 011-4241 5179

Business Head

Nimisha Shah 99671 11587

Speaking of challenges, in this issue of VM&RD, we have

focused on two very key issues that we observed in the

industry today. One is about the business opportunities

or rather the lack of them for retail design consultants

and what’s hampering their growth. The other is about

the future direction of retail fixture exporters in India. As

it happens in most cases, these are issues that stem from

multiple factors and therefore need a multi-pronged

approach to address them.

Marketing Executive - West & South

Neha Jante 98450 11541

Sales Executive - South

Binayak Biswas 8870312069

Sales Executive - North & West

Sudarshan Sakhare 86690 68831

Subcription:

VM-RD Visual Merchandising & Retail Design is a monthly Owned, published and

edited by Vasant Jante, printed by B S Suresh Pai, published from 1019/2, 1st Main,

1st Cross, Geetanjali Layout, New Thippasandara, Bangalore-560 075 and printed at

Sri Sudhindra Offset Process, #97-98, D.T. Street, 8th Cross, Malleswaram, Bangalore

- 560 003.

The opinions expressed by authors and contributors to VM-RD are not necessarily

those of the editor’s or publishers. VM-RD may not be reproduced in whole or in part

without permission of the publisher.

Print Copy

Subscription for one year Rs: 1,200/For Nepal Rs 5,000/For overseas US $ 190

Do read them and let us know your thoughts. And of

course don’t miss our cover story on how Reliance Brands

has crafted a premium retail offering in a tier 2 city like

Ahmedabad or the other Indian design features that we

have for you.

I leave you now to read and mull over all that we have. I

hope these stories, along with ISA 2019, will give us an idea

of what’s in store for the retail industry in the coming days

of the year.

Vasant Jante

Editor & Publisher

Digital Copy

Subscription for one year Rs: 400/All subscriptions are to be pre-paid. The claims and statements made in the

advertisements in VM-RD are those of the Advertisers and are in no way endorsed or

verified by VM-RD

3

January 2019

Contents

6

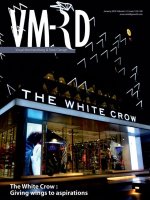

COVER STORY

The White Crow : Giving wings to aspirations

14

INDUSTRY FOCUS

What’s derailing retail design consultants’

growth journey?

18

FIXTURES

Are Indian retail fixture manufacturers on the

crossroads?

22

PHYGITAL

‘Phygital requires the whole eco

system to evolve’ - Vishal Kapoor

26

32

38

INDIAN DESIGN

Taneira

Sri Sai Kanchi Shubham

Titan Eyeplus

42

IN-STORE ASIA 2019

You have a Store, but do you have a story?

Visit ISA 2019 to decode all the conundrums

50

COLUMN

Elke Moebius, Global Head of Retail / Retail

Technology Director EuroShop and EuroCIS

52

ADVERTORIAL

Nancy Advertising – Galloping towards

excellence

53

IN-STORE ASIA 2019 EXHIBITOR LIST

60

RETAIL SOLUTION PROVIDERS

January 2019

4

Abstract MANNEQUINS Pvt. Ltd

Mannequins | Dress Forms | Garment Steamers | Luxury Hangers | VM Props | Bust Forms | Store Fixtures

298, Prakash Mohalla, East of Kailash, New Delhi-110 065 M : +91-9999898307

www.abstractmannequins.com

Cover Story

6

The White Crow :

Giving wings to aspirations

Reliance Brands Ltd.’s new retail initiative, The White Crow, spread across 8,000 sq ft at Sindhu Bhavan Road in

Ahmedabad, is the first ever concept store bringing together all the premium brands under one roof. The idea is to

give a multi-sensory experience to customers looking for a premium offering. In an exclusive interview with VM&RD,

Darshan Mehta, President & CEO - Reliance Brands Limited (RBL), takes us through the journey of The White Crow

(TWC) and shares some insights on how every step in the retail design journey was driven by a close understanding of

how the consumer thinks and behaves.

L

ocated on the high street of Ahmedabad,

The White Crow store is RBL’s first ever

concept store. Spread across 8,000 sq

ft, the store is designed to bring Indian and

global premium brands together under one

roof. With brands like Superdry, Salvatore

Ferragamo, Scotch & Soda, Adidas Originals,

Brooks Brothers, Onitsuka Tiger, G-Star Raw,

Steve Madden, Armani Exchange, Coach,

Diesel, Replay, Dune, DC Shoes, Canali and

Kate Spade, among others, offered within

a single door, TWC addresses the needs

of the fashion conscious and aspirational

consumers of luxury in the city of Ahmedabad.

But more interestingly, the store is an

example of a contemporary retail format

built from a close understanding of what

the consumer prefers and how he or she

behaves – right from the store design

to the brand selection and the shopper

experience.

Format driven

customer shops

by

how

Darshan Mehta, President & CEO - Reliance Brands Limited

a

One of the most interesting aspects of TWC

is the concept of mixed merchandising,

as against the usual shop-in-shop format

and the categorisation based on products

rather than brands. The store thus presents

a uniquely curated fashion collection from

over 44 premium brands. The products

themselves are divided under 8 fashion and

lifestyle categories – casual wear, formal

wear, customisation section, fragrance

library, handbags & shoes, collectibles,

luggage and tableware.

Speaking about the store format,Darshan

Mehta, President & CEO - Reliance Brands

Limited (RBL) said “This unique format

is intuitive to how a customer shops. A

customer doesn’t use the same brand for

all her dressing needs. The chances are

that a woman will wear a Zara top with a

Diesel denim and accessorize with a Jimmy

Choo shoe and Gucci handbag. At TWC a

customer will find products from multiple

premium brands at the same place. For

instance, a Superdry hoodie can be seen

next to a GAS denim and an Armani

Exchange shoe.”

Brothers shirt or an Armani Exchange shoe,

it is an effective cue to the customer’s

mind about a possible fashion trend and

combination,” he added.

“The mixed merchandising also helps in

suggestive selling. So if a customer sees a

Replay Hyperflex denim next to a Brooks

According to Mehta, while shop-inshop is a 20-year old concept, the mixed

merchandising format is more customer-

7

January 2019

friendly, helping shoppers pick from

a plethora of choices across all the

categories offered in the store.

Also, TWC plans to add new brands every

month to keep up with the customer’s

preference. This is unlike the practice

followed for the metro cities. “We are

constantly changing/ adding/ rotating

brands every month to give the customer

an added reason to come and check

out the store more frequently. And

this doesn’t happen in metro cities like

Bombay or Delhi,” Mehta said.

Brand positioning – a onepoint destination for the

fashion lovers

With TWC, RBL is essentially aiming at

creating a fashion destination and in

the process creating access to multiple

premium brands and the corresponding

environment for shopping. Here again,

the choice of brands is driven by what

today’s customer seeks. As Mehta said,

“I don’t differentiate between Indian

and global brands. I think that’s an

obsolete concept. To me Raghavendra

Rathore and Brooks Brothers are both

premium brands. A Raghavendra Rathore

bandhgala can be paired beautifully with

a Diesel denim and you will find both the

brands together in our store. Similarly, a

woman would as much fancy a nice Anita

Dongre dress as a Jimmy Choo shoe and

possibly wear them together.”

January 2019

Catering to contemporary

needs & sensibility

The store look again is a reflection of

contemporary India with a space that is

designed to evoke a fresh and premium

feel, which is in sync with the aspirational

needs of the customers.

“We wanted to make sure the store

environment is not intimidating and, at

the same time, aspirational. We wanted

to create a store that you have never seen

before. The space lends a warm feeling; it

is hospitable and it is unique. In terms of

design, we have virtually scored a 95 /100,”

Mehta explained.

The glass and wooden shelving system is

an integral part of the store, and the fitouts are given an orange hue. The store has

a light neutral colour scheme that envelops

the entire design.

It took 12 months to complete the

store design process and the space was

designed by an award winning interior

design agency, ST Design. The retail

exerience concept is done by brand and

8

retail innovation company, Few Steps

Ahead, while the branding has been done

by an internal designer at RBL.

Interestingly, the entire store design

journey is also an example in creative

freedom and in finely blending aesthetics

with the reigning cultural ethos. As Mehta

explained, “I firmly believe that if your

design head feels very strongly about

something then you should give him or

her the leeway because he or she is the

expert. For example, initially I had some

reservations about using orange in the

store, but my designer convinced me

that India is known and loved around the

world as a vibrant and colourful country

and orange goes with that image. He

turned out to be right. For when I walked

into the store and saw the fit-out stand, I

knew it was a contemporary version of

the traditional image of India. So trust

between the designer and the client is very

important in the whole design process.”

Crafting the right customer

experience

In the context of customer experience in

retail, phygital has become a buzz word

today but Mehta believes that Indians

are not yet ready for phygital. “Phygital is

overdone in the western countries where

manpower is scarce. But Indians still love

the human touch, they love people over

digital services. When a customer goes to a

store, they like to have human interaction

January 2019

before buying a product or while browsing

the product range. They don’t want to go

and stand in front of a kiosk. They would

rather have human assistance while

making a purchase,” he pointed out.

This belief and understanding of the Indian

psyche is reflected in TWC. For example, the

store has a Brother sewing machine right in

the middle of the store for craftsmanship

and customisation. If a customer wants a

customised denim or an alteration s/he can

get it done right at the store.

“Interestingly, the Brother sewing machine

has actually been appreciated by a lot

by our customers. They said it felt good

because it gave a sense of being in a

clothing store. Thus, it also helped in

connecting with the customer by giving

a sense of familiar comfort without being

overtly loud,” Mehta highlighted.

As part of enhancing the customer

experience, the store also houses the Santé

Spa Café, which serves a range of vegan

and gluten free food. So while the store is

spread across 5,200 sq ft, the café occupies

an additional space of 2,600 sq ft. “Through

this approach we are trying to give a

holistic experience to the customers. This

is something that doesn’t exist in India,”

Mehta said.

A strategic choice of location

TWC is part of RBL’s efforts to take their

premium segment across apparel, footwear

10

and lifestyle categories to mini-metros and

smaller towns, again a result of their close

study of emerging markets and consumer

profiles in the country.

Highlighting the reason behind choosing

a mini-metro city, Mehta said, “The idea is

to launch the concept of a departmental

store in a different and unique way in a

city like Ahmedabad which has a ready

purchasing power. There is no multi-brand

format of international brands in India to

make the customer experience wholesome

and complete in overall lifestyle purchase.”

Also as he added, outside the key metro

cities, there is a high purchasing power in

cities like Ahmedabad, Lucknow, Jaipur and

even Guwahati. But it may not be always

feasible to build malls or put up individual

mono brand stores at these places. “Also,

the departmental stores presence in India

is quite mainstream. That prompted us to

open an MBO concept store in a city like

Ahmedabad.”

“Ahmedabad, a city with population of

9 million people, has just one mall in the

town called the Alpha Mall, where we have

2 stores – Hamleys and GAS. The mall is

fully leased out for 9 years and we were

literally waiting with a token in hand for

a place to get vacant to open a Brooks

Brothers store, a Superdry store,a Steve

Madden store, an Armani Exchange store, a

Canali store etc., but we did not get a spot,”

he further added.

to bring Pottery Barn and West Elm in

India. This will also mean a new category

in TWC portfolio - home décor and home

improvement. The company has also

partnered with Replay – an Italian premium

denim and casual wear brand - to open

Replay stores in India. As of now, The White

Crow is all set to give ‘Ahmedabadians’ a

new retail experience to indulge in and a

true taste of premium luxury. l

Smita Sinha

Concept Design

ST Design, Hong Kong.

However, given the existence of ready

purchasing power and wealth in the city,

Ahmedabad was an easy choice for RBL to

open an MBO format in the city. According

to a report by Boston Consulting Group

(BCG), population in tier II- IV will increase

4.5 times by 2025 and also by 2025, tier II

and III towns will account for 45% of India’s

consumption and add 30% of affluent

households, who will be a significant

market for premium luxury products.

“Two indications that Ahmedabad has

high purchasing power – one is the fact

that the city has at least 5-6 high-end

car showrooms. Secondly, the flight

connectivity, between Mumbai and Delhi

- Ahmedabad is very good at 19-20 flights

per day with high seat occupancy. Location

is an important factor in the success of any

Retail format and Ahmedabad was a ready

market for us, given its affluent customer

base and connectivity,” Mehta explained.

RBL is now planning to open TWC stores

January 2019

in other cities like Lucknow, Jaipur and

Guwahati.

Summing up the journey

Talking about the obstacles in the whole

journey towards creating an experiential

store, Mehta said, “The only challenge that

we faced was that there wasn’t a mall or

a beautiful high-street in which we could

set up presence of our premium brands.

But with TWC we have overcome this

challenge. And the kind of response we got

in the first 5 weeks has been mind blowing.

The response was positive in sales,

footfalls, conversions and all the other key

performing indicators that we use to track

success in Retail.”

Going forward RBL is planning to add more

brands every month to the existing 44 brands.

“We have a hot pipeline, we keep adding new

brands every month,” Mehta said.

RBL has also recently announced a

partnership with Williams-Sonoma, Inc.

12

Architect & PMC

Amol Talekar, Pune

Retail Experience Design

Few Steps Ahead, New Delhi

General Contractor

Shilpi Designers, Mumbai

Flooring

Greenheart Floors, New Delhi

Fixtures & Furniture

Elemental Fixtures Pvt Ltd, Bangalore

Lighting

Focus Lighting & Fixtures Ltd, Mumbai &

JN Lighting India LLP, Mumbai,

Speciality Value Lighting& Design,Mumbai

Signage

Ubiquitous Signs Pvt Ltd, Mumbai

Hangers & Mannequins

Abstract Mannequins, New Delhi

VM Props & Window Display

HG Graphics, New Delhi

Industry Focus

What’s derailing

retail design consultants’

growth journey?

Even as retail remains the key element in any brand narrative, the growth story of the Indian retail industry is

hardly reflected in the performance of Indian retail design consultants. Is it because of lack of enough retail

design consultants in the country who can offer end to end solutions? Or is it due to inadequate understanding

of retail design as a holistic experience? Or, is it about not giving retail design its due? It appears that a

combination of factors has affected the growth of retail design consultancy as a segment in its own right, as

VM&RD finds out.

January 2019

14

F

rom disruptive brand deployment

to clutter breaking storytelling,

retail brands are leaving no stone

unturned in sprucing up their brickand-mortar presence. What’s more,

brands from across a range of segments

and categories are today joining the

retail bandwagon in India, focused on

crafting an impactful retail experience.

An industry body study shows that

retail has emerged as one of the most

dynamic industries in the country,

reportedly accounting for over 10% of the

country’s GDP and around 8% of the total

employment. The report also says that

while the overall retail market is expected

to grow at 12 % per annum, modern

trade would grow at 20 % per annum and

traditional trade at 10 %.

Also, the rise in retail projects means better

business for the retail design consultants

in the country. As Mumbai-based retail

designer Shravan Suthar, Principal

D e s i g n e r ,

Shravan Design

C o m p a n y ,

according to

whom his 15-year

old company has

grown 100% over

the last 7 years,

explains, “Retailers

who had stores

spanning not more than 500-1000 sq ft

are now going up to 5000 sq ft with ease.

Therefore, there’s a clear increase in the

number of square feet we are working

with.”

This obviously means higher business

volumes for retail design agencies and

it would seem that all is hunky dory for

the industry, with a robust eco-system of

retail solution/service providers, all equally

poised for growth, right? Wrong. The fact

is that while there are many architectural

agencies who are into retail design, there

are very few consultants specializing in

retail design as a complete solution in

the industry. Also, while many of these

consultants have made their way up the

ladder to become the most sought-after

names, their individual growth seems

rather stunted, certainly not commensurate

with the growth of Indian retail as a whole.

Understanding the crux of retail

experience

It appears that these gaps are a reflection

of larger issues, beginning with a lack of

understanding of retail experience as a

concept in itself. Now interestingly, even

after brick-and-mortar made its glorious

comeback, not many, particularly among

the retailers, seem to have really cracked

the essence of what a retail experience is

all about or have spent enough resources

to understand customer behavior.

Shyam Sunder, Co-founder of Four

Dimensions Retail Design, says in this

regard, “Though

we are talking

about retail

experience being

the paramount

for retail success,

many brands, even

those investing in

retail designers,

have no clear idea

about it. As they scale up their stores, they

also end up constantly changing their

retail designers, to suit their budget. What

happens as a result is that they can’t achieve

uniform ID across all stores. It’s important

for brands to understand the objective of

design so that there is collective benefit.”

As a result of inadequate understanding

of retail experience, the whole eco system

suffers, in particular the retail design

consultancy business, as retailers do not

feel the need to invest in a retail design

consultancy firm for consistency of ID or

design purpose.

Says Sanjay Agarwal, Founder, Future

Retail Design Company (FRDC), in this

regard,

“There’s

an

issue

in

understanding

design in this

country. We look

at design from the

aesthetic or luxury

point of view, but

often forget that

design is ultimately

a tool to solve problems. Therefore, the

research methodology becomes very

important for us even before proposing a

design of a store. Now, in order to invest

sufficient effort to do that, we often need

longer duration and the lost time is never

compensated. This often leads us to incur

losses. I can only infer that there’s a severe

need for understanding design at all levels.”

Dhiren Chheda, Founder of Mumbaibased Dhiren Chheda Associates, agrees,

“Research even before design is the most

crucial and challenging part. In addition

15

to that, as a retail

design firm, if you

give special focus

to timeline, the

volume of your

rollout goes down.

Therefore,

we

cannot do more

than 50 stores a

year. In the latter

case, brands go to several agencies to

duplicate the design and there remains a

chance of the soul of the IDs getting lost.

Now, if the brand’s earnestness towards

restoration of design ID and therefore the

budget is conducive, we can take up fewer

brands but can take care of complete

rollout.”

Thus it’s the retail design consultant who

again suffers, because when the project is

done in piecemeal and not as a complete

roll out, then the returns don’t justify the

efforts and cost involved in it. And in the

end, between tight time lines and lack of

enough bandwidth to match the scale of

store rollout plans, what gets lost is the

core of retail experience – a right blend of

physical design and intangible elements.

Seeking international expertise

So the challenges seem to lie in a vicious

circle – retailers don’t focus on store

design as a consistent long-term plan and

therefore go to retail design firms for last

minute store executions, which is time

and pressure bound and offers no scope

for creating unique design concepts. Since

these projects do not monetarily sustain

the design consultancy firms on a long

term basis, they are constrained and unable

to add more value to what they can offer to

the retail clients. The high end organized

retailers in the country thus end up going

to international design consultants to meet

their retail requirements. A look at any of

these top retail entities shows that their

designs were handled by international

retail agencies – ‘HD retail ID’ for Central

was done by Blocher Blocher, Foodhall at

Chanakya, Delhi by Paris-based Melherbe,

Croma’s small format true blue omni

channel ID by Chute Gardeman, Airtel’s

phygital ID by London-based Eight Inc. The

list goes on.

These are retailers who pay Rs 100 lakh

plus as design consultation fee and in

some cases even go up to Rs 200 lakhs. So

here is the other side to the issue, which is

the perspective of these high-end retailers

according to which, design consultants

January 2019

from the West come with end-to-end

solution comprising graphic design, brand

communication, the whole works, while

India’s top retail design consultants are

more of interior designers. So while Indian

retail design consultancy firms have their

own reasons as to why they are not able to

offer complete design solutions, their top

end retail clients seem to have a different

take.

Need for infrastructural

investment

But as stated above, retail designers need

to be assured of consistent revenues to

be able to build the infrastructure that

can help them cater to their top end

clients. According to industry sources, no

top agency is achieving more than Rs 5

crore annual turnover solely from concept

design. This is unlike the international

scene where many retail agencies sustain

themselves solely on concept design work

and stay away from rollout jobs. Indian

retail agencies on the other hand are forced

to rely on store roll-outs for their business

volumes. As Shyam of Four Dimension says,

“We are doing 600 stores a year across 47

brands. I won’t say that we have not grown.

But let me tell you, our sole concept design

revenue has grown marginally. 55% of our

total turnover is still achieved from rollout,

while the rest comes from concept design.

And, we have been in business for the last

18 years. Ideally we should have grown

equally in both the verticals but pure-play

concept design fees are too meagre to

sustain the business. ”

This again is a reflection of larger issues

such as insufficient focus given to store

design as long term initiative by retail

brands. So the crux of it is that if retailers

can look at design as something that needs

separate investments in terms of expertise

and planning and hire retail design

consultants as partners who can offer

concepts and not just do store rollouts,

then it would lift the whole industry. It

would give the retail design consultancy

firms the assurance of long term revenues

which can help them build infrastructure,

talent and research capability to offer more

to their clients, including concepts and end

to end design solutions.

The way ahead

Of course this is not to say that the design

consultancy firms have to wait for the

retailers to change their approach. In fact

the good news is that a few retail design

January 2019

Need of the hour – A Quick Checklist

Focus on design as a complete solution on the part

Separate budget allotments for design concept development and store roll-out on the

part of retailers

More retail design training programmes, apart from the one offered by NID, with

contemporary course content that can churn out industry-ready design professionals

Dedicated resources for research and infrastructure on the part of retail consultants

Collaborative approach between retailer/brand and the retail designers for a complete

retail solution

Realistic time line for the project completion and compensation for delay from the

retailer side.

consultants are already investing resources

in research and strategy before getting

down to designing the stores. As they

point out, Indian customer demography is

unique, which only Indian retail agencies

can understand and translate into a

workable design solution for retailers. But

the need is for more such research backed

retail design strategies and for retailers to

understand and acknowledge this.

The fact is that a retail unit or a store is

more than just a spectacular space. And

this is something that all stakeholders

need to clearly focus on – both the retail

brands and the retail designers. This also

means requiring the right kind of talent,

because retail design falls somewhere

between pure art and pure science. So the

need is for expertise that understands it

from both these perspectives. But while

retail

designers

are trained and

honed on job,

there is no formal

training imparted

to them and this is

another issue. As

Ashateet Saran

of Chennai-based

Saran Associates,

says ruefully, “There’s no proper course,

nothing even remotely close to a training

program that young retail design aspirants

can opt for and get industry-ready. What’s

more disappointing is that pure-play

architecture is often preferred over design.”

Indeed, a few leading design institutes

have started offering courses in retail

design, but the course content is often

not on par with contemporary and global

trends. So clearly there is a big need for

cutting edge retail design training, among

other factors.

Well, the sooner these industry musthave’s are in place – retailer acceptance of

16

Indian design consultancy as a necessity

for a good store experience and better

profitability for retail design consultancy

firms so that they can invest in research

capability, infrastructure and industryready talent – the better. After all, world

over retail behemoths have re-strategized

their store size, space, merchandising

and the overall design of retailing. And

for Indian retail to keep pace with these

trends would mean a strong retail design

consultancy industry which can sustain

itself on pure play design. This means a

collaborative strategy between both the

retail brand and the retail designer for

delivering a complete design solution –

one that is tuned to customer behaviour

and matches the need of the hour. l

Satarupa Chakraborty

Fixtures

Are Indian retail fixture

manufacturers on the crossroads?

India’s fixture manufacturing industry is fast making its presence on the international retail map, thanks to its

fast-evolved manufacturing processes, value engineering and affordable labour cost. But the fact is that the

success is still confined to a few topline names. Also the export percentage for each has still not crossed the

20% mark. So what can make this number go up? A combination of higher retailer confidence in Indian fitout manufacturers and improved capability on the part of the industry with strategic partnerships can make a

difference, finds out VM&RD.

F

irst the good news. In a survey done

by VM&RD last year among 26 leading

fixture manufacturers in the country,

it was observed that the number of players

with 100,000 sq ft facility had grown

substantially in the last few years, with

the average area fitted by each company

almost doubling in the last two years, from

3.25 lac sq ft to 5.9 lac sq ft per supplier.

The better news is that top line brands

like Apple, Scotch N soda, Superdry, H&M,

etc., which began by importing their line

of fixtures eventually gained confidence in

Indian vendors.

Also, if we gauge the growth of store fitout vendors across all categories, fixture

manufacturers seem to have more to

show compared to their counterparts in

other categories. The above mentioned

VMRD survey also revealed that while

the percentage of exports by the leading

January 2019

vendors has not really increased in last

couple of years, the number of exporting

companies grew from 39% to almost 50%.

Also with India’s organized retail growing

significantly at a CAGR of 20-25%

annually (Source : Anarock Retail Report),

there is huge scope for store fit-out

manufacturers in the country. Besides,

Indian manufacturers have also been able

to gain traction as fit-out experts among

SAARC countries such as Sri Lanka, Dubai

and Africa. Starting relatively earlier

compared to other service providers, the

Indian fixture industry, aided by focus on

R&D and infrastructure development, is

exporting significantly to these countries.

But now comes the sobering part. Despite

these cheering projections, there’s still

a sizeable number of global brands

including Aldo, Charles & keith, Only, Vero

18

Moda, Jack & Jones etc, who even after

a good stint of retail operation in India,

are still importing their store fixtures.

So, even as Indian fixture manufacturers

are proving their competence as global

supplier to top-notch brands, there are

still many brands shying away from

outsourcing their fixture requirements to

Indian manufacturers. Why is this so? Is it

a matter of perception? Or is there more?

What’s the positioning in the

global market?

One reason could be the lack of a clear

communication of USP or positioning. A

look at other exporting countries shows

that every fixture exporter comes with

a distinct USP – China is known for its

competitive and cheap pricing, Italy and

other European countries for the sleekness

of their fixtures, USA, for reliability in terms

of load bearing, compliances, turnaround

time etc. But when it comes to India it

appears that fixtures manufacturers have

not yet carved a distinct positioning in the

International market.

Industry experts feel that is because they

are unclear as to what to expect from

the market and what direction to take,

which involves extensive market research.

Says Huzefa Merchant, Founder & CEO,

Insync Shopfittings / Safe Enterprises,

explaining this, “We have always shied away

from

predictive

research on what’s

next. For example,

we

did

some

extensive research

o n d i ff e r e n t

parts of the

world

including

countries

such

as Dubai, Turkey,

Germany etc.,

before launching our Fit N Lite system,

which is a customized display system

for retail stores. Sporadically designed

products may not work very well in

international markets.”

Nilesh

Rathod,

F o u n d e r ,

E n s e m b l e

Infrastructure

agrees “While

the last few years

have moved

r e t a i l fi x t u r e

manufacturing

to metal usage, we still have to wait

and watch if the demand is for larger

sustainable supply chain. There are still

some of affluent retail brands who are

opting for sizeable import. Therefore,

we guess that there’s a big substitution

market, which is yet to happen. We can

only wait and watch.” What this means is

that with no clear picture on what trends

to expect from international trends, Indian

fixture manufacturers seem unable to

crack the export market in order to grow

further.

PKN Nambiar, CEO, Electrospark, which

clocked a turnover of INR 100 crore in

less than 10 years and whose exports

constitute about 15%, shares a similar

view, “The biggest

roadblock

is

uncertainty. While

I am gearing up

big for export of

other engineering

products, I am not

too sure of retail

fixtures. While in

the Indian market,

we can manage bulk business with the

brands, when it comes to exports, we

have go through buying agencies. Even

after putting in the same kind of effort, we

end up receiving minuscule orders. Also,

there’s a dearth of projection and welldrafted roadmap for the next few years.

It’s not too business-friendly to execute

orders on an immediate basis.”

It is probably due to these reasons that

19

the average turnover of leading Indian

fixture manufacturers in the last two

years has dropped by about 19%, most

probably abetted by fall in prices and

further spread of the pie shared by smaller

and newer players. And while the number

of exporting companies has seen a jump

of about 10% in the same time window,

almost no company has crossed 20% when

it comes to the export size of their overall

produces, as already mentioned.

Due to the obvious challenges many retail

fixture manufacturers possibly don’t see

much returns coming from investing in the

efforts to draw in an international clientele.

As industry players point out, deeper the

pocket, bigger the export size. And even

though there has been a significant surge

in infrastructure development for catering

to domestic market, the prototyping effort

for the global markets, which is largely

price-sensitive, does not commensurate

well with medium and small sized fixture

manufacturers.

However, with the retail business

increasingly going global and India

becoming a hub for global players,

catering to the international market would

be an inevitability.

The way forward

So how can the Indian retail fixture

industry tap the export market in a growth

conducive manner? And what is the next

step for them? The fact is, as pointed

out by industry players, although there’s

January 2019

collective effort towards R&D pertaining to

materials and manufacturing process and

simplifying packaging and logistics, almost

no thought leadership is shown towards

customer-centric design or geographyoriented research from the fixture

manufacturers. So as already mentioned,

market research would probably be the

first important factor.

Also, success in the export market is a longterm process which requires patience and

sustained efforts.

Says Ragesh Bhatia, Director, Renam

Retail, which is planning to double its

exports by the

year end, “We

understand that

maintaining

quality along with

price

sensitivity

require deep

pockets and

sustenance power.

However, if you

can hang in there,

the effort gets justified. Look at Chinese

manufacturers. Contrary to popular notion

about compromised quality, China has

sustained its superpower as exporting

mammoth also on the basis of quality.

And, that has happened over a long period

of time.”

The good news once again is that there has

been a consistent surge in participation

from Indian fixtures companies at global

retail trade shows such as the iconic

Euroshop, especially in the fixture and

lighting categories. Says Murali Balgar,

Director, Disha

Retail Fixtures,

“We have come

a long way, not

only in design and

manufacturing

processes

but

also in packaging,

well- engineered

installation-ready

products

and

logistics. Technology and engineering

have played hand-in-hand roles in this

process. We have recently been appointed

as the global supplier of one of the major

US retailer. It’s true that the export success

is still confined to only the top ones, but

the volume of success is commendable.”

But for the success to spread to more

number of players in the industry would

also mean meaningful tie-ups with

industry names across different countries,

who can pave the way to market Indian

January 2019

Opportunity

Growth

Reality

Checklist

Emergence

of African

countries and

Sri Lanka as

retail hubs.

Some noted

international brands

are appointing Indian

vendors as their global

suppliers.

Even the leading

companies are

exporting only

10-20% of their

overall produce.

Tie-up with

international fixture

leaders to not only

market products but

to understand trend.

Price dropdown

of almost 50%

compared

to global

manufacturers.

More and more

international brands

slowly but surely found

confidence in Indian

manufacturers.

Positioning Indian

fixture produces

collectively in a

“brandmark” way.

What should they

stand for?

Europe and

USA, once

complacent

in their

manufacturing

processes are

now looking at

India to import

their fixtures.

Number of exporting

companies has grown

by about 10% in last

2-3 years.

Prototyping

and approval

process need

deeper pocket

and unjustifiable

timeframe to

achieve sizeable

business.

Logistics cost is

still a concern

among smaller

players.

A handful of top

companies are looking

to double their exports

by next fiscal.

Dearth of

projection on

Last year, 5 Indian

distinct offerings.

retail store vendor

companies

participated in

Euroshop, out of

which 3 were fixture

companies

Improvement

in shipping and

packaging quality

Increasing the

reliability factor

specially pertaining

to timeline/delivery.

Introduction of

standardized line of

fixtures

Consistent research

on global market.

Value engineering

for ease of

installation.

Introduction of

automation in the

manufacturing

process

Time pertaining to

logistics has been

minimized.

Focus towards

standardized and ease

of installation.

vendors. For example, Spanish company

Kider India was taken over by Indian

promoter in 2014. Even with its Spanish

heritage, the company, with its target

to achieve 10% business from exporting

to European countries, is going in for

technical tie-ups with Polish and Spanish

leaders.

Says Manu Sharma, President, Instor

by Kider India Pvt Ltd, explaining this,

“Though we have

been aggressive

in improving our

facility as per

global benchmark,

we realized that

only the respective

market leaders can

pave our way to

success in exports.

20

These tie-ups will help us in specialized

R&D before we win a sizeable scale of

operation, post which we can be on our

own.”

Well, it certainly looks like research, clear

market positioning and strategic tie-ups

with international industry leaders, are

some of the things that the industry needs

to adopt to grow in the export market.

And last but not the least, is that top-end

retailers need to realize that numbers

do not always reflect the story. So even

though Indian fixture manufacturers may

not show big numbers in their export

kitty, it is in no way an indication of their

expertise. On the other hand, it only shows

that there is need for greater confidence

and willingness to explore their capability

on the part of the retailers. l

Satarupa Chakraborty

Phygital

‘Phygital requires the whole eco

system to evolve’

The line dividing the physical and digital worlds is blurring like never before and new age shoppers are

increasingly looking for a digital interface to facilitate a speedy and smart shopping experience. This has driven

retailers across the world to integrate technology in order to reinvigorate their business plans. Keeping pace

with these changes are a few Indian retailers like the Future Group who have already started drawing up a

blended commerce strategy to bring everything to the customer’s doors and finger tips.

VM&RD catches up with Vishal Kapoor, Chief Design Officer, Future Group, to know more about the

company’s approach to phygital and India’s readiness for phygital.

I

n the context of creating a better retail

experience, phygital seems to be the

buzz word now. How will phygital

change the Indian retail scenario? What

difference do you think it will make to

both the retailers and the customers?

When we talk about phygital, there

are two sides to it – one is the frontend consisting of the direct customer

experience and the second is the back-end

which gets integrated into the business,

thereby feeding the front-end. In India,

the so called ‘digital interface’ began

on the front-end, more as a customer

visual attraction. Today many retailers,

including us, are connecting the whole

ecosystem of retail through an integrated

technology platform to know and service

the customer better. This can only happen

if you have an integrated and contextual

technology behind to deliver what the

January 2019

customers have, what they possibly want

and accordingly service their needs.

Currently Phygital retail is I would say at

a nascent stage and we still have to see

complete case studies. But the process

has already begun, and I think in the next

five or six years, we will see quite a bit of

changes on that front where technology

will play a crucial role, both at the customer

interface side and at the back end through

better handling of big data and providing

relevant insights followed by prescriptive

analytics. Essentially we will witness valueadded actions for end-users through

products or services.

Technologies like beacon sensing system,

facial recognition, customised advertising,

cashless shopping etc., will provide the

end to end cycle of observation, insights,

ideation and action in a cyclic pattern.

22

For instance, when the customer visits

a store, the facial recognition technolgy

based on her past visits and accumulation

of data would provide detailed analytics

of the profile helping the retailer to

know here choices of products styles,

brands, size etc. With these insights

the serviceability factor can be greatly

increased. The offers and suggestions can

be highly personalised and a conversation

can be started between the retailer and

customer. With beacons and scanners, the

particular customer can be tracked inside

the store and based on her browsing time

at any shelf area, customized marketing

or offer provisions can be done. This

personalisation can even be followed

into the trial rooms where she can simply

interface on the digital screen her choices

of different sizes or color and she would

be serviced that choice. Choice of final

product can also lead into a cashless

aisle integrated with the payment portal

through scan technologies as basic as QR

codes to RFID. This being connected to

digital wallets makes the entire transaction

speedy and hassle-free.

Such and mutliple other varieties of case

studies can be realistically expected from

more and more retailers in future.

The caveat here is that we don’t get

obsessed by the “technology” and forget

the human factor, which stems from

the cultural and behavioural context.

Technology has to be always chosen as

an enabler and not as the literal solution.

The central idea is that design has to be

in a larger context of integrating creative

ideas for business value-add through

technology.

Do you think Indian retail is ready for

phygital?

phygital as an integrated holistic solution

and not as a single feature.

evolve on one side and massify on the

other thus providing price stability.

Indian retailers might not be able to offer

a complete phygital experience, as their

developed global counterparts do. Only a

few premium stores in our country would

probably be able to include the entire

assortment of phygital. But definitely

we would see parts of it integrated. The

smart choices for retailers would involve

using the right technology, one which

gives them business value add and can be

seamlessly integrated into their evolving

organisation systems, both technologically

and culturally. Sometimes the technology

can almost seem like an alien force in the

internal organization context, losing it

effectiveness and the whole purpose.

Rising service expectancies of consumers,

the opening of markets and the resulting

competition will push for higher

benchmarks, with the online market

infusion further raising expectancies

of convenience and price. The physical

retailers, while being conscious of

these factors, also constantly challenge

themselves

on

better

experience

deliverables.

Apart from price, the challenge would be

to align with the right kind of adoption

and integration to generate maximum

business value. Surface level technology

adoption is just a hardware installation and

its benefits would be limited to generating

some eye balls for some time before it

becomes obsolete . The deeper integration

into the organization working systems and

enterprise resource planning would make

the connect between the customer and

organisation more meaningful.

Physical retail will always work on great

and unique experiences and if technology

can help in converging to that goal

smoother and faster it becomes a strong

enabler.

What do you think are the key factors

that will make phygital work?

One of the key factors is the introduction of

Hence as time and space meanings

get redefined, technology would be an

enabler. The physical will rely on digital

for speed and digital on physical for

experience and human touch.

So, beyond the blinding glow of

technology lies the value adding nuggets

which needs to be picked up at the right

time, in the right place and for the right

reason.

Do you think cost, challenges in finding

the right solution providers, etc., are

perceived as deterrents to the growth

of phygital?

What are the other challenges in

integrating phygital?

Yes, at the introductory stage cost always

is something to think about because

markets are experimenting with the new

technologies but with higher adoption,

technology always has the feature to

Adoption into the existing organization

systems specially for large operating

systems would be a challenge. Phygital

will cause evolution in the management

of enterprise processes like supply

23

January 2019

chain, stock planning, human resources,

marketing methodology etc.

Phygital - Key Takeaways

Technology is always attuned to changes

and evolution and mostly faster than

anticipated. This would challenge the

archaic methodologies and resources and

hence it’s also going to be a challenge in

the cultural context.

- Technologies like beacon sensing

system, facial recognition, customised

advertising, etc., will play key role in

driving business empowering insights

- Technology is not the end but the

means for better business value and

customer experience

Cost, I always believe, is the outcome of

balancing vision with decision, so this

factor sooner or later can be dealt with.

- Need of the hour is for a holistic

solution which can be seamlessly

integrated into the culture and

business

Rajiv Prakash of Next In recently said

that it’s important to think like a startup in order to offer the right phygital

experience? What is your take on that?

What is the kind of ecosystem needed to

make phygital work?

Yes, you have to think like a start-up

because start-ups have the ability to adapt

to new things and are agile. The start-up’s

way of working is very different from a

large organisation, but as you try to adapt

this technology to a large organisation,

then I believe there has to be something

more than just a start-up mindset. Startups don’t always think from the longterm business perspective of profit

generation, as the inclination is more

towards evaluation, customer acquisition

and scaling up. So medium and large

retailers will also have to adopt a large

organisational way of thinking, where

cash flow and net revenues are important

survival aspects.

What do you think can make a retailer

or a brand allot the required budget for

phygital?

First factor is the larger global trend of

transforming retail through phygital, so

to some degree it will have its influence.

Globally, a lot of retailers are going

phygital. For instance, Nike has recently

opened a new store which is based on the

phygital principles.

The Amazon Go stores, Alibaba’s Hema

supermarkets etc, all lead to this direction

and hence become an inspiration to

learn and adopt. Even today we see the

technology investments being much

higher YOY if we do a comparative analysis

of the last decade.

Customers’ value for time and convenience

and their need for memorable experience

would

direct

retailers

to

adopt

technologies integrated with design and

business.

January 2019

- Solution providers should offer

something comprehensive and not

have a transaction based approach

- Need more successful case studies

for retailer to learn and adopt

- Idea is not to replace human touch

but to enable a smooth interface

According to a study, 79 % of users want

human touch over digital customers

service channels in India? This is true

isn’t it? For in India, we do prefer the

human interface. So, given this, how do

you think phygital will be successful in

India?

This is true, in India, majority of the

preference is for physical. The fear of

physical retailers being displaced by online

is baseless. In fact, we have seen globally

online retailers taking over and buying out

physical retailers and also experimenting in

physical formats but based on their design

ethos and philosophy. Digital cannot be

an exclusive value-add and cannot be

a forced wiring between the customer

and the retailer. Human touch will never

lose its value and hence technology will

simply help in reducing negative labour,

cutting time friction and focusing on

the experience strategy to stimulate the

sensory perceptions.

Any particular category where you

think phygital will work better?

Any well thought over strategy based on

deep insights of customer and market

need across the categories of fashion,

food and home would see the value add

of phygital.

Aspects of curation, product information,

personalised marketing, transparency

of sourcing to bring up more customer

24

confidence etc., all lead to areas of physical

supplemented by digital. The idea is to

integrate the whole system in a way where

there is service, information and sensory

inputs all connected together.

Any message you want to share with the

retail solution providers in the context

of phygital?

Retail solution providers should give a

comprehensive solution, and not come

with a mindset of transaction. The OEM

(original

equipment

manufacturer)

mindset has to evolve to ODM (own design

and manufacturer) to OSM (own strategy

manufacturer). Eventually it’s not about

the hardware or the software, but about

integrating it into the organizational

strategies and aligning your service

strategies accordingly, in a holistic

manner.l

Smita Sinha

www.theflagcompany.in

THE FLAGS AND SIGNAGE PVT LTD

(The Flag Company)

Front

Back

LED BACKLIT FABRIC LIGHT BOX

CEILING-WALL-NICHE-SELF STANDING

Print width up to 10 feet Installation across India, backlit and front lit fabrics, Made in India

PIONEERS OF FLAG, BANNER, FABRIC SIGNAGE

Office address:Shop No 7, Andheri Universal Industrial Estate,Opp Andheri Sports Complex, Azad Nagar Metro,Next to A H Wadia

School, J P Road, Andheri West, Mumbai - 400053. India. Phone -022- 2625 1620 - 21 / +91 9820627530 /

+91 9820687287 / +91 9820026977 | Email: fl | Website: www.theflagcompany.in

Factory adress:Mumbai Ahmedabad Road, NH No8, Village Juhu Chandra , TAluka - Vasai , Dist. Thane, Western Express Highway,

Near Lodha Dham Jain Temple.Naigoan east Mumbai 401202. Phone +91 73500 89655