Chương 4 Chính phủ trong nền kinh tế hỗn hợp ppt

Bạn đang xem bản rút gọn của tài liệu. Xem và tải ngay bản đầy đủ của tài liệu tại đây (113.22 KB, 9 trang )

Chapter 4

Government in the mixed economy

David Begg, Stanley Fischer and Rudiger Dornbusch, Economics,

6th Edition, McGraw-Hill, 2000

Power Point presentation by Peter Smith

4.2

What do governments do?

■

create laws, rules and regulations

■

buy and sell goods and services

■

make transfer payments

■

impose taxes

■

try to stabilize the economy

■

affect the allocation of resources

4.3

Government spending

0

10

20

30

40

50

60

% of national income

1880 1929 1960 2000

The scale of government activity has grown steadily in

industrial countries since 1880

Japan

USA

Germany

UK

France

Sweden

4.4

What should governments do?

■

Governments may be justified in

intervening in the economy in the

presence of market failure

■

Six ways in which intervention may

improve the allocation of resources:

4.5

What should governments do?

■

(1) The business cycle

–

decisions on taxation and spending may affect the

business cycle

–

not always favourably

■

(2) Public goods

–

goods that, even if consumed by one person, are

still available for consumption by others – e.g.

clean air

–

the free-rider problem prevents the market from

achieving production of the “right” amount of such

goods.

4.6

What should governments do?

■

(3) Externalities

–

costs and benefits of production are not

always reflected in market prices

➡

e.g. pollution, congestion.

■

(4) Information-related problems

–

private markets may not produce the

“right” kinds and amounts of information

➡

e.g. food labelling, health and safety

regulations.

4.7

What should governments do?

■

(5) Monopoly and market power

–

resource allocation may be improved by

limiting or regulating the market power of

monopoly firms

■

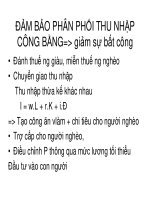

(6) Income redistribution and merit goods

–

concern with equity issues

➡

e.g. protecting vulnerable groups

–

merit goods are goods that society thinks people

should consume regardless of income

➡

e.g. health, education

4.8

Who pays a commodity tax?

D

S

S

Q

0

P

0

Quantity

Price

With no tax, market

equilibrium is at P

0

, Q

0

S'

S'

Q

1

P

1

With the tax, supply is S'S'

and equilibrium is P

1

Q

1

…but who pays the tax?

4.9

C

Area C is a

welfare loss.

B

Area B is borne

by producers

A

Area A is borne

by consumers

Who pays a commodity tax?

D

S

S

S'

Q

1

Q

0

P

0

P

1

S'

The incidence of the

tax depends upon the

elasticities of demand

and supply.