Infltion and case study of zimbabwe during 2008

Bạn đang xem bản rút gọn của tài liệu. Xem và tải ngay bản đầy đủ của tài liệu tại đây (322.47 KB, 23 trang )

CHAPTER I. MONEY

I. What is Money?

• Anything that is generally accepted in payment for goods

and services or in the repayment of debts

• Money is distinct from income and wealth

II. Functions of Money

1. Medium of exchange

Money's most important function is as a medium of exchange to

facilitate transactions.

Without money, all transactions would have to be conducted

by barter, which involves direct exchange of one good or service for

another. The difficulty with a barter system is that in order to obtain

a particular good or service from a supplier, one has to possess a

good or service of equal value, which the supplier also desires. In

other words, in a barter system, exchange can take place only if

there is a double coincidence of wants between two transacting

parties.

The likelihood of a double coincidence of wants, however, is small

and makes the exchange of goods and services rather difficult.

Money effectively eliminates the double coincidence of wants

problem by serving as a medium of exchange that is accepted in all

transactions, by all parties, regardless of whether they desire each

others' goods and services.

2. Store of value.

In order to be a medium of exchange, money must hold its value

over time; that is, it must be a store of value.

If money could not be stored for some period of time and still remain

valuable in exchange, it would not solve the double coincidence of

wants problem and therefore would not be adopted as a medium of

exchange.

As a store of value, money is not unique; many other stores of value

exist, such as land, works of art, and even baseball cards and

stamps. Money may not even be the best store of value because it

depreciates with inflation. However, money is more liquid than

most other stores of value because as a medium of exchange, it is

readily accepted everywhere. Furthermore, money is an easily

transported store of value that is available in a number of convenient

denominations.

3. Unit of account.

Money also functions as a unit of account, providing a common

measure of the value of goods and services being exchanged.

Knowing the value or price of a good, in terms of money, enables

both the supplier and the purchaser of the good to make decisions

about how much of the good to supply and how much of the good to

purchase.

CHAPTER II. INFLATION

I. Definition

• Inflation is a sustained increase in the price level of goods and

services in an economy over a period of time.

• Inflation rate: inflation rate is a measurement of inflation, the

rate of increase of a price index (e.g. consumer price index). It

is the percentage rate of change in prices level over time.

• Inflation affects economies in various positive and negative

ways. The negative effects of inflation include an increase in

the opportunity cost of holding money, uncertainty over future

inflation which may discourage investment and savings, and if

inflation were rapid enough, shortages of goods as consumers

begin hoarding out of concern that prices will increase in the

future. Positive effects include reducing unemployment due to

nominal wage rigidity.

II. Measure inflation

In North America, there are two main price indexes that measure

inflation:

1. Consumer Price Index (CPI)

A measure of price changes in consumer goods and services such as

gasoline, food, clothing and automobiles. The CPI measures price

change from the perspective of the purchaser. U.S. CPI data can be

found at the Bureau of Labor Statistics.

2. Producer Price Indexes (PPI)

A family of indexes that measure the average change over time in

selling prices by domestic producers of goods and services. PPIs

measure price change from the perspective of the seller. U.S. PPI

data can be found at the Bureau of Labor Statistics.

In the long run, the various PPIs and the CPI show a similar rate of

inflation. This is not the case in the short run, as PPIs often increase

before the CPI. In general, investors follow the CPI more than the

PPIs.

III. Inflation and Interest Rate

Inflation and interest rates are often linked, and frequently

referenced in macroeconomics. Inflation refers to the rate at which

prices for goods and services rise. In the United States, the interest

rate, or the amount charged by lender to a borrower, is based on the

federal funds rate that is determined by the Federal Reserve

(sometimes called "the Fed").

In general, as interest rates are reduced, more people are able to

borrow more money. The result is that consumers have more money

to spend, causing the economy to grow and inflation to increase. The

opposite holds true for rising interest rates. As interest rates are

increased, consumers tend to save as returns from savings are

higher. With less disposable income being spent as a result of the

increase in the interest rate, the economy slows and inflation

decreases.

Under a system of fractional-reserve banking, interest rates

and inflation tend to be inversely correlated. This relationship

forms one of the central tenets of contemporary monetary policy:

central banks manipulate short-term interest rates to affect the rate

of inflation in the economy.

CHAPTER III. MONEY SUPPLY AND INFLATION

Rapid increases in the money supply can be the result of poor

management by the central bank or by a decision to print money to

support government spending.

A frequent problem in developing nations is that governments

without stable or consistent tax collections often resort to printing

money to finance government spending

Money becomes worthless if too much is printed.

If the Money Supply increases faster than real output then,

ceteris paribus, inflation will occur.

If you print more money, the amount of goods doesn’t change.

However, if you print money, households will have more cash and

more money to spend on goods. If there is more money chasing the

same amount of goods, firms will just put up prices.

The Quantity Theory of Money

The Quantity theory of money seeks to establish this connection with

the formula:

MV = PY

Where:

M = Money supply

V = Velocity of circulation (how many times money

changes hands)

P = Price level

Y = National Income (T = number of transactions)

If we assume V and Y are constant in short-term, then increasing

money supply will lead to increase in price level.

Example:

Simple example to explain why printing money causes inflation:

Suppose the economy produces 1,000 units of output.

Suppose the money supply (number of notes and coins) =

$10,000

This means that the average price of the output produced will

be $10 (10,000/1000)

Suppose then that the government print an extra $5,000 notes

creating a total money supply of $15,000; but, the output of

the economy stays at 1,000 units. Effectively, people have more

cash, but, the number of goods is the same. Because people

have more cash, they are willing to spend more to buy the goods in

the economy.

Ceteris paribus, the price of the 1,000 units will increase to

$15 (15,000/1000). The price has increased, but, the quantity of

output stays the same. People are not better off, and the value of

money has decreased; e.g. A $10 note buys fewer goods than

previously.

Therefore, if the money supply is increased, but, the output

stays the same, everything will just become more expensive.

The increase in national income will be purely monetary (nominal)

If output increased by 5%. and the money supply increases by 7%.

Then inflation will be roughly 2%.

Assumptions in the above example

[In the real world, it is possible, if the government printed money,

people would just decide to save the extra money and therefore,

prices wouldn’t automatically rise. However, to simplify the link

between the money supply and inflation, let us assume that

consumers are willing to spend the extra money. Also, if you expect

inflation to rise, you have an incentive to spend it – rather than see

the value of your money fall.]

CHAPTER IV. INFLATION: HARMS AND BENEFITS

I. HARMS

1. Discourage investment

Inflation tends to discourage investment and long-term economic

growth. This is because of the uncertainty and confusion that is more

likely to occur during periods of high inflation. Low inflation is said to

encourage greater stability and encourage firms to take risks and

invest.

2. Menu costs

Menu costs refer to an economic term used to describe the cost

incurred by firms in order to change their prices. For example, it may

be necessary to reprint menus, update price lists or re-tag

merchandise on the shelf. Even when there are few apparent costs to

changing prices, changing prices may make customers apprehensive

about buying at a given price, resulting in a menu cost of lost sales.

3. Inflation causes more inflation

Inflation urges people to spend and invest, which in turn tends to

boost inflation, creating a potentially catastrophic feedback loop. As

people and businesses spend more quickly in an effort to reduce the

time they hold their depreciating currency, the economy finds itself

awash in cash no one particularly wants. In other words, the supply

of money outstrips the demand, and the price of money – the

purchasing power of currency – falls at an ever-faster rate.

The result is hyperinflation. Hyperinflation can destroy an economy.

It can wipe out the savings of the middle-classes, and redistribute

wealth and income towards those with debt and assets and property.

Some infamous examples: Germans papering their walls with the

Weimar Republic's worthless marks (1920s), Peruvian cafes raising

their prices multiple times a day (1980s), Zimbabwean consumers

hauling around wheelbarrow-loads of million- and billion-Zim dollar

notes (2000s) and Venezuelan thieves refusing even to steal

bolívares (2010s).

4. Cost of reducing inflation

To restore price stability, Governments/Central Banks need to pursue

deflationary fiscal/monetary policy. However, this leads to lower

aggregate demand and often a recession. The cost of reducing

inflation – is unemployment, at least in the short-term.

II. BENEFITS

1. Increase economic productivity

When the economy is not running at capacity, meaning there is

unused labor or resources, inflation theoretically helps increase

production. More dollars translates to more spending, which equates

to more aggregated demand. More demand, in turn, triggers more

production to meet that demand.

Famous British economist John Maynard Keynes believed that some

inflation was necessary to prevent the "Paradox of Thrift." If

consumer prices are allowed to fall consistently because the country

is becoming too productive, consumers learn to hold off their

purchases to wait for a better deal. The net effect of this paradox is

to reduce aggregate demand, leading to less production, layoffs and

a faltering economy.

2. Reduce unemployment

The increased production stated above may lead to the need for

more workers, thus leads to more jobs vacancies.

An other explanation is based on wage’s stickiness. As wages tend to

be sticky, which means they change slowly in response to economic

shifts, once inflation hits a certain rate, employers' real payroll costs

fall, and firms are able to hire more workers.

3. Increase economic growth

Inflation discourages saving, since the purchasing power of deposits

erodes over time. That prospect gives consumers and businesses an

incentive to spend or invest. At least in the short term, the boost to

spending and investment leads to economic growth. Speaking

above, inflation's negative correlation with unemployment implies a

tendency to put more people to work, spurring growth.

4. Encourage borrowing and lending

Inflation also makes it easier on debtors, who repay their loans with

money that is less valuable than the money they borrowed. This

encourages borrowing and lending, which again increases spending

on all levels.

CHAPTER V. INFLATION: EXAMPLE AND ANALYZE

I. Case Study

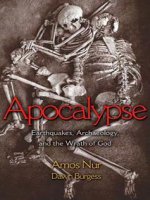

Studied case: Hyperinflation in Zimbabwe during 2008

II. Analysis

1. Overview

On 18 April 1980 Zimbabwe gained official independence from the

United Kingdom under the leadership of Robert Mygabe. At that

time, Zimbabwe had strong colonial infrastructure, a high level of

cohesion and an abundance of government promises of reform.

People in Zimbabwe had every right to believe that Zimbabwe could

become one of the strongest independent African state. However,

due to the 2008 hyperinflation, Zimbabwe is now one of the poorest

countries in the world as life expectancy is low and malnutrition is

becoming a serious problem in this country.

2. Causes

The reasons behind Zimbabwe’s crisis are complex and interrelated,

here may be the major causes:

• Zimbabwe introduced its new currency - Zimbabwe dollar to

replace the Rhodesian dollar, which has been introduced in

1970, at the rate of 1:1. At that time, a Zimbabwe dollar was

actually worth more than the US dollar in the exchange market

(1ZWD = 1.47 USD), however on the open and goods market,

this did not reflect accurately its purchasing power and as a

result, the currency had already started to erode over the

years.

• The

government

decided

to

adopt

Economic

Structural

Adjustment Programme (ESAP) as a fix to some problems in the

economy such as

inhibited investment and employment,

constricted credit and foreign exchange and this brought

negative effect to the Zimbabwean economy. The ESAP

involved decreasing in the government expenditure by a

combination

of

rationalization

cuts

of

in

public

public

enterprise

sector

deficits

employment,

and

trade

liberalization, removal of subsidies, devaluation of the local

currency, privatization and enforcement of cost recovery in the

health and education sectors with the hope to create a new era

of modernized competitive and export led industrialization and

economic efficiency.

• The government further implemented land reforms that aimed

at chasing white landowners and giving their pieces of lands to

black people.

• The increase in money supply did not equate to an increase in

productivity in the Zimbabwean economy, and there was little

new investment to create new goods.

3. Consequences

• A dramatic increase in unemployment rates as people can no

longer afford for education, medical care resulting in doctors,

nurses among other professionals joining the steady outward

migration to neighbouring countries which offered better

employment prospects. Veterans of Zimbabwe's liberation war

also began to feel the pinch of a declining economy and to

agitate government for greater monetary assistance for their

efforts in the liberation struggle. The collapse was triggered by

the government's decision in 1997 to ignore fiscal constraints

by making large payments to veterans of the independence

struggle, as a way of buying their loyalty and political support

in the upcoming elections.

• Food output capacity fell 45%, manufacturing output 29% in

2005, 26% in 2006 and 28% in 2007, and unemployment rate

rose to 80% , life expectancy dropped.

4. Solution to Zimbabwe’s inflation

The government of Zimbabwe made the decision to print more

money in order to buy as much goods as before. The result was the

faster the price increased, the more money they need to print and as

the newly - printed money began to enter the market, the price

increased, creating a feedback loop. From 2000, the inflation rate

increased drastically. By 2001 prices were rising at a rate of 110%

per year, followed by 200% in 2002, 600% in 2003.

Overtime, the government had to redenominate the Zimbabwe dollar

three times with denomination up to a $100 trillion banknote issued,

making Zimbabwe dollar one of the lowest valued currency in the

world. In 2006, Zimbabwean people have to pay several thousands

of dollars to buy food per day. It all came down to 2008 when

hyperinflation (7.6 billion percent per month) and economic troubles

wiped out the wealth of citizens and set the country back more than

a half century.

The Zimbabwean dollar was basically worthless so Zimbabweans

refused to use it. Robert Mugabe, the president of Zimbabwe had no

choice but to abandon its currency, legalized transaction in foreign

currency such as U.S dollar, Australian dollar, British pound, Euro,

Chinese Yuan ... and Government accounts became denominated in

United States dollars in 2009

As a result of this dollarization and the installation of a national unity

government in 2009, the economy rebounded and had slow growth,

the Zimbabwe hyperinflation was officially over.

The problems have yet to over for the people in Zimbabwe. As

Zimbabwe is a trade deficit country (Zimbabwe imports more than it

exports so the total amount of dollars in the country is constantly

decreasing), there will be a chronic shortage of physical US dollar in

the country. As a result, in 2016, the government introduced “bond

notes” and officially announced that it was supposedly backed by a

$200 million loan from the African Export Import Bank and would be

traded 1:1 with the US dollar. However, the public was not buying it

as they were afraid that the government was making the same

mistake and this would cause another hyperinflation like in 2008.

The result was that the bond notes began to lose value as soon as

they were introduced. In the early 2019, the central bank tried again:

this time, the pseudo-currency was called the Real Time Gross

Settlement (RTGS) dollar — effectively a digital currency — and the

bank abandoned the pretence that it would be equivalent to the US

dollar, instead suggesting that 2.5 RTGS dollars to US$1 would be an

acceptable exchange rate. Again, the RTGS dollar is beginning to

lose value immediately.

CHAPTER VI. SOLUTIONS

Inflation can be solved in a variety of ways one solution of inflation is

the involvement of each section of the government when making all

the important decision such as printing of the country currency. The

president will receive information from the economic experts on the

importance of printing money thus making him more aware of the

effects.

The other way of reducing inflation is to reduce wars that are

commonly being experienced in the world today (Shah, par 4). These

reduced cases of political instability will result to easy flow of raw

materials thus reducing inflation.

Another way of reducing the cases of inflation in the developing

countries, is when the developing countries stop or reduce the cases

of international debts and start to depend on their own resources.

This will subsequently make the countries to keep the interests for

themselves and thus use it to develop there country and economy.

Summary of policies to reduce inflation

1. Monetary policy:

Higher interest rates. This increases the cost of borrowing and

discourages spending. This leads to lower economic growth and

lower inflation.

2. Tight fiscal policy

Higher income tax and/or lower government spending, will

reduce aggregate demand, leading to lower growth and less

demand pull inflation

3. Supply side policies

These aim to increase

long-term

competitiveness,

e.g.

privatisation and deregulation may help reduce costs of

business, leading to lower inflation.

Policies to reduce inflation in more details

1. Monetary Policy

In the UK and US, monetary policy is the most important tool for

maintaining low inflation. In the UK, monetary policy is set by the

MPC of the Bank of England. They are given an inflation target by the

government. This inflation target is 2%+/-1, and the MPC use

interest rates to try and achieve this target.

The first step is for the MPC to try and predict future inflation. They

look at various economic statistics and try to decide whether the

economy is overheating. If inflation is forecast to increase above the

target, the MPC are likely to increase interest rates.

• Increased interest rates will help reduce the growth of

aggregate demand in the economy. The slower growth will then

lead to lower inflation. Higher interest rates reduce consumer

spending because:

• Increased interest rates increase the cost of borrowing,

discouraging consumers from borrowing and spending.

• Increased interest rates make it more attractive to save money

• Increased interest rates reduce the disposable income of those

with mortgages.

• Higher interest rates increased the value of the exchange rate

leading to lower exports and more imports.

Diagram showing fall in AD to reduce inflation

2. Supply Side Policies

Supply side policies aim to increase long term competitiveness and

productivity. For example, it was hoped that privatization and

deregulation would make firms more productive and competitive.

Therefore, in the long run, supply side policies can help reduce

inflationary pressures. However, supply side policies work very much

in the long term; they cannot be used to reduce sudden increases in

the inflation rate. Also, there is no guarantee government supply

side policies will be successful in reducing inflation.

3. Fiscal Policy

This is another demand side policy, similar in effect to monetary

policy. Fiscal policy involves the government changing tax and

spending levels in order to influence the level of Aggregate Demand.

To reduce inflationary pressures the government can increase tax

and reduce government spending. This will reduce AD.

4. Exchange rate policy

Sterling exchange rate index, which shows value of Sterling against

basket of currencies.

In the late 1980s, the UK joined the ERM, as a means to control

inflation. It was felt that by keeping the value of the pound high, it

would help reduce inflationary pressures.

A stronger Pound makes imports cheaper (lower cost-push inflation)

Stronger Pound reduces domestic demand, leading to less demandpull inflation. A stronger Pound creates incentives for firms to cut

costs in order to remain competitive.

The policy did reduce inflation but at the cost of a recession. To

maintain the value of the £ against the DM, the government had to

increase interest rates to 15%, and this contributed to the recession.

The UK no longer uses this as an anti-inflationary policy.

5. Wage Control

Wage growth is a key factor in determining inflation. If wages

increase quickly, it will cause high inflation. In the 1970s, there was a

brief attempt at wage controls which tried to limit wage growth.

However, it was effectively dropped because it was difficult to

enforce widely.

6. Targeting Money Supply (Monetarism)

In the early 1980s, the UK adopted a form of monetarism, where the

government sought to control inflation through controlling the

money supply.

To control the money supply, the government

adopted higher interest rates and reduced budget deficit. It did bring

inflation down but at expense of deep recession. Monetarism was

effectively abandoned because the link between money supply and

inflation was weaker than expected.