Financial accounting chapter 10 liabilities kế toán nợ

Bạn đang xem bản rút gọn của tài liệu. Xem và tải ngay bản đầy đủ của tài liệu tại đây (1.05 MB, 50 trang )

10-1

Chapter 10

Liabilities – Kế Toán Nợ

Learning Objectives

After studying this chapter, you should be able to:

1. Explain a current liability, and identify the major types of current

liabilities.

2. Describe the accounting for notes payable.

3. Explain the accounting for other current liabilities.

4. Explain why bonds are issued, and identify the types of bonds.

5. Prepare the entries for the issuance of bonds and interest expense.

6. Describe the entries when bonds are redeemed.

7. Describe the accounting for long-term notes payable.

8. Identify the methods for the presentation and analysis of non-current

liabilities.

10-2

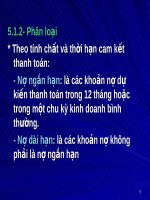

Current liability

A debt that the company expects to pay within one

year or the operating cycle, whichever is longer.

Most companies pay current liabilities by using current

assets.

LO 1 Explain a current liability, and identify the

major types of current liabilities.

Current liabilities include notes payable, accounts payable, unearned

revenues, and accrued liabilities such as taxes, salaries and wages, and

interest payable.

Current Liabilities

10-3

The time period for classifying a liability as current is one

year or the operating cycle, whichever is:

a. longer

b. shorter

c. probable

d. possible

Question

LO 1 Explain a current liability, and identify the

major types of current liabilities.

Current Liabilities

10-4

LO 2 Describe the accounting for notes payable.

Notes Payable

Recorded obligation in the form of written notes.

Usually require the borrower to pay interest.

Issued for varying periods of time.

Those due for payment within one year of the statement

of financial position date are usually classified as current

liabilities.

Current Liabilities

10-5

Illustration: Hong Kong National Bank agrees to lend

HK$100,000 on September 1, 2014, if C.W. Co. signs a

HK$100,000, 12%, four-month note maturing on January 1.

Instructions

a) Prepare the journal entry on September 1.

b) Prepare the adjusting journal entry on December 31,

assuming monthly adjusting entries have not been made.

c) Prepare the journal entry at maturity (January 1, 2015).

LO 2 Describe the accounting for notes payable.

Current Liabilities

10-6

Notes payable

100,000

Cash 100,000

Interest payable

4,000

Interest expense 4,000

HK$100,000 x 12% x 4/12 = HK$4,000

b) Prepare the adjusting journal entry on Dec. 31.

LO 2 Describe the accounting for notes payable.

Current Liabilities

Illustration: Hong Kong National Bank agrees to lend

HK$100,000 on September 1, 2014, if C.W. Co. signs a

HK$100,000, 12%, four-month note maturing on January 1.

a) Prepare the journal entry on September 1.

10-7

Interest payable 4,000

Notes payable 100,000

Cash

104,000

LO 2 Describe the accounting for notes payable.

Current Liabilities

Illustration: Hong Kong National Bank agrees to lend

HK$100,000 on September 1, 2014, if C.W. Co. signs a

HK$100,000, 12%, four-month note maturing on January 1.

c) Prepare the journal entry at maturity (January 1, 2015).

10-8

LO 3 Explain the accounting for other current liabilities.

Sales Tax Payable

Sales taxes are expressed as a stated percentage of

the sales price.

Either rung up separately or included in total receipts.

Retailer collects tax from the customer.

Retailer remits the collections to the government’s

department of revenue.

Current Liabilities

10-9

Illustration: The March 25 cash register reading for Cooley

Grocery shows sales of NT$10,000 and sales taxes of NT$600

(sales tax rate of 6%), the journal entry is:

Sales revenue

10,000

Cash 10,600

Sales tax payable

600

LO 3 Explain the accounting for other current liabilities.

Current Liabilities

10-10

LO 3 Explain the accounting for other current liabilities.

Unearned Revenue

Revenues that are received before the company delivers goods

or provides services.

1. Company debits Cash, and credits

a current liability account

(Unearned Revenue).

2. When the company earns the

revenue, it debits the

Unearned Revenue account,

and credits a Revenue account.

Current Liabilities

10-11

Illustration: Busan IPark (KOR) sells 10,000 season football

tickets at W 50,000 each for its five-game home schedule. The

club makes the following entry for the sale of season tickets (in

thousands of W):

LO 3 Explain the accounting for other current liabilities.

Unearned ticket revenue

500,000

Cash 500,000Aug. 6

Ticket revenue

100,000

Unearned ticket revenue 100,000Sept. 7

As each game is completed, Busan IPark records the revenue

earned.

Current Liabilities

10-12

Current Maturities of Long-Term Debt

Portion of long-term debt that comes due in the

current year.

Considered a current liability.

No adjusting journal entry required.

LO 3 Explain the accounting for other current liabilities.

Current Liabilities

10-13

Current liabilities are presented after non-current

liabilities on the statement of financial position.

A common method of presenting current liabilities is to

list them by order of magnitude, with the largest ones

first.

Presentation

Statement Presentation and Analysis

LO 3 Explain the accounting for other current liabilities.

10-14

Statement Presentation and Analysis

Illustration 10-3

LO 3 Explain the accounting for other current liabilities.

10-15

Liquidity refers to the

ability to pay maturing

obligations and meet

unexpected needs for

cash.

The current ratio

permits us to compare

the liquidity of different-

sized companies and of

a single company at

different times.

Illustration 10-5

Illustration 10-4

LO 3 Explain the accounting for other current liabilities.

Analysis

Statement Presentation and Analysis

10-16

A form of interest-bearing notes payable.

To obtain large amounts of long-term capital.

Three advantages over ordinary shares:

1. Shareholder control is not affected.

2. Tax savings result.

3. Earnings per share may be higher.

LO 4 Explain why bonds are issued, and identify the types of bonds.

Non-Current Liabilities

Bond Basics

Obligations that are expected to be paid after one year.

10-17

Effects on earnings per share—equity vs. debt.

Illustration 10-7

LO 4 Explain why bonds are issued, and identify the types of bonds.

Bond Basics

10-18

The major disadvantages resulting from the use of bonds

are:

a. that interest is not tax deductible and the principal

must be repaid.

b. that the principal is tax deductible and interest must

be paid.

c. that neither interest nor principal is tax deductible.

d. that interest must be paid and principal repaid.

Question

LO 4 Explain why bonds are issued, and identify the types of bonds.

Bond Basics

10-19

Types of Bonds

LO 4

Bond Basics

10-20

Government laws grant corporations power to issue

bonds.

Board of directors and shareholders must approve bond

issues.

Board of directors must stipulate number of bonds to be

authorized, total face value, and contractual interest rate.

Terms of the bond are set forth in a legal document

called a bond indenture.

Issuing company arranges for printing of bond

certificates.

Bond Basics

Issuing Procedures

LO 4 Explain why bonds are issued, and identify the types of bonds.

10-21

Represents a promise to pay:

►

face value at designated maturity date, plus

►

periodic interest at a contractual (stated) interest

rate on the maturity amount (face value).

Interest payments usually made semiannually.

Generally issued when the amount of capital needed is

too large for one lender to supply.

Bond Basics

Issuing Procedures

LO 4 Explain why bonds are issued, and identify the types of bonds.

10-22

Maturity

Date

Maturity

Date

Illustration 10-8

Contractual

Interest

Rate

Contractual

Interest

Rate

Face or

Par Value

Face or

Par Value

DUE 2017 DUE 2017

2017

LO 4

Issuer of

Bonds

Issuer of

Bonds

Bond Basics

10-23

Bond Trading

Bond Basics

Bondholders can sell their bonds, at any time, at the

current market price on national securities exchanges.

Bond prices are quoted as a percentage of the face value.

LO 4 Explain why bonds are issued, and identify the types of bonds.

Application

$952.50 $1,018.75

(2) What is the price of a $1,000 bond trading at 101 7/8?

Application

(1) What is the price of a $1,000 bond trading at 95 1/4?

10-24

Bond Trading

Bond Basics

Bondholders can sell their bonds, at any time, at the

current market price on national securities exchanges.

Bond prices are quoted as a percentage of the face value.

Newspapers and the financial press publish bond prices

and trading activity daily.

LO 4 Explain why bonds are issued, and identify the types of bonds.

Illustration 10-9

10-25

Bond Trading

Bond Basics

Bondholders can sell their bonds, at any time, at the

current market price on national securities exchanges.

Bond prices are quoted as a percentage of the face value.

Newspapers and the financial press publish bond prices

and trading activity daily.

A corporation makes journal entries only when it issues

or buys back bonds, or when bondholders exchange

convertible bonds into ordinary shares.

LO 4 Explain why bonds are issued, and identify the types of bonds.